Ethereum is a decentralized, open source platform for building decentralized applications (Dapps) based on smart contracts.

The creator of Ethereum is the co-founder of Bitcoin Magazine — Vitalik Buterin, who described the idea of this blockchain in one of his publications in 2013. In April 2014 Ethereum was formally described by Gavin Wood in the so-called “yellow book”.

In 2014 Vitalik won a start-up technology competition and received $100’000 as a reward, which he invested in the development of Ethereum.

Ethereum network was launched on July 30, 2015. In June 2016 an error was detected in the program code of The DAO (one of the projects based on Ethereum), which had led to fork and the emergence of Ethereum Classic (for more details, see Trust Index section).

After successful ICO, many large companies, such as Microsoft, IBM, Acronis, international charitable organization UNICEF, large banks and airlines of different countries became interested in Ethereum.

Ethereum is currently the second most popular blockchain project after Bitcoin.

Ethereum platform token is called Ether. For designation, the abbreviation ETH and the symbol in the form of Greek letter Ξ (Xi) are used. Fractional parts have their own names: 1/1000 — finney (Hal Finney — the first Bitcoin user, after Satoshi Nakamoto), 1/106 — szabo (Nick Szabo — the creator of the idea of smart contracts), 1/1018 — wei (Wei Dai — the creator of b-money concept, which, in fact, is the ancestor of Bitcoin).

Ethereum ICO was held in the second half of 2014 and lasted for 42 days, during which 31’591 BTC were collected, which at that time was equivalent to $18’439’086. The ICO had sold 60’102’216 ETH.

The volume of initial emission was 72 million ETH. Later Ethereum protocol allowed to get 5 Ethers (ETH) for each mined block. The total number of emitted Ethers is in no way limited. Thus, inflation was assumed to be constant. Over the next 3 years after the launch of the network, another 28 million tokens were mined. Now (September 2018) the number of tokens exceeds 102 million. Thus, the actual inflation rate of Ethereum is amounted to 10% per year.

However, since it is planned to switch from PoW to PoS (for more details, see Consensus Building Mechanisms section), then, according to developers, inflation will drop to 0.5-2% per year.

Vitalik Buterin repeatedly spoke about inflation problem and ETH emission, but he did not want to resort to Bitcoin method and to limit emission. In 2016 Buterin predicted that the emission of Ether will not exceed 100 million coins in a very long term. But the forecasts did not materialize, and Vitalik again returned to this issue in April 2018 and this time he proposed to limit the issue of coins to 120 million. Over the past years, several solutions have been proposed to limit emission, but developers decided not to do this before the implementation of Casper protocol.

ETH tokens can be obtained by mining. At the moment (September 2018) the reward is 3 ETH per block. With the implementation of Casper protocol, the block reward will be reduced to a fixed size of 0.6 ETH.

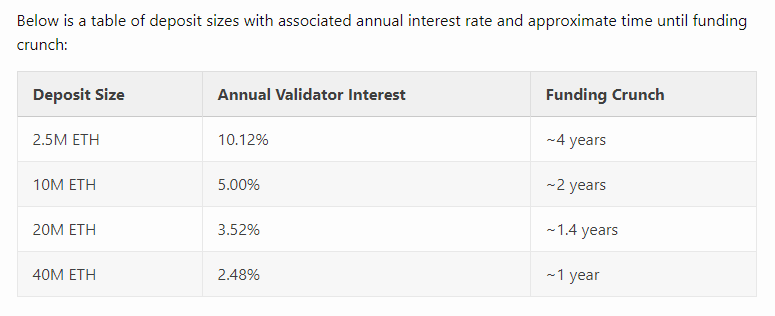

Yield chart for validators after switching to PoS:

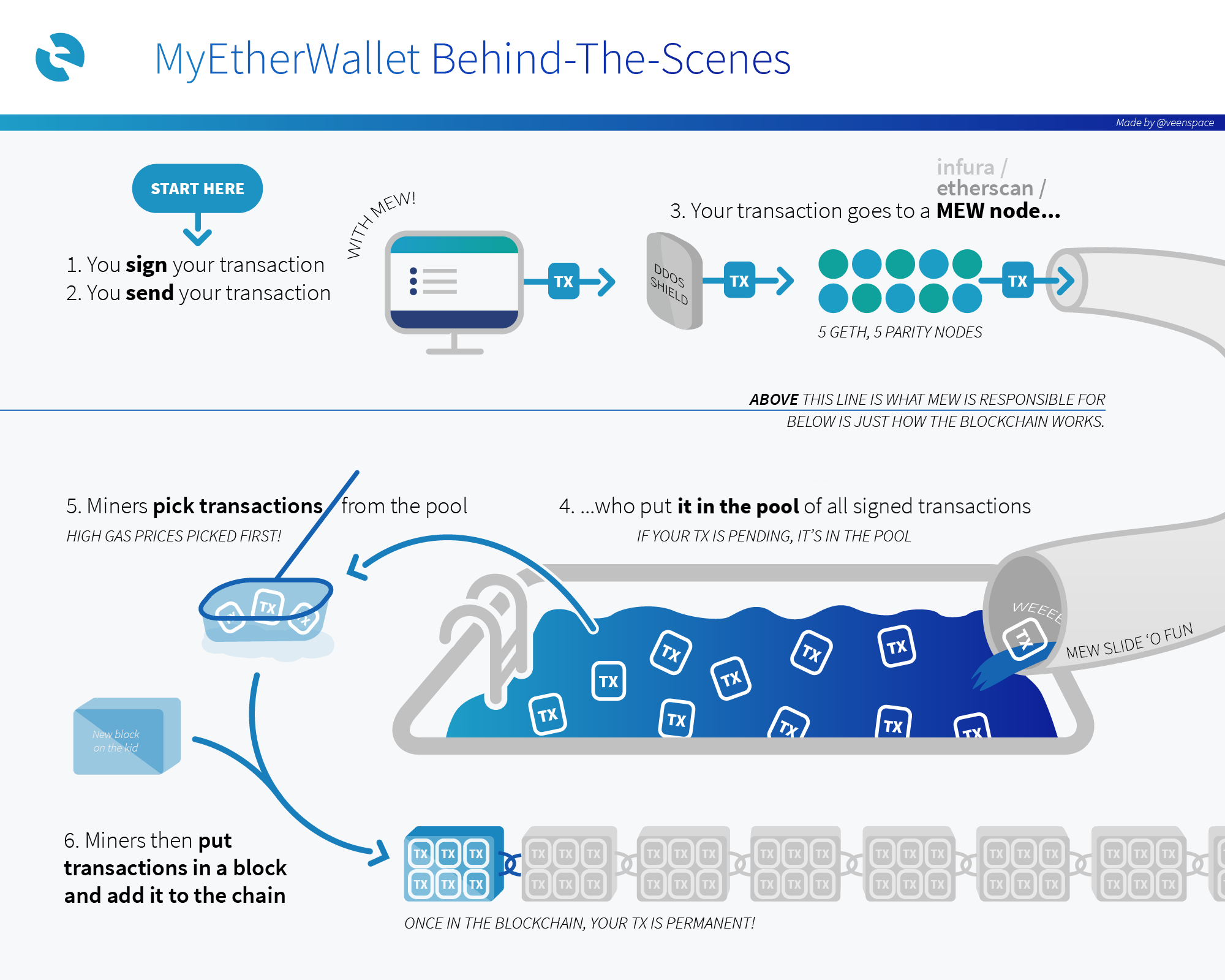

In order to perform transactions or execute contracts, Gas (gas, fuel) is used in Ethereum for paying commissions. Gas converts to ETH, user sets the cost per gas unit. But since miners receive commission for transaction, they choose transactions with the highest gas cost from the pool. To set the gas cost, the fractional part GWEI (1 GWEI = 0.000000001 Ether) is used. The average price of gas is about 20 GWEI, current prices can be viewed on Etherscan.io.

The cost of one transaction is 21000 Gas. The network also has the concept of “gas limit” — this is the maximum number of gas units that a user is willing to spend on transaction. This helps to avoid situations where, due to an error in the contract, an amount significantly exceeding transaction value is written off. If a gas limit exceeds transaction cost, then all unused gas will be returned at the end of transaction. If the cost of transaction reduces by lowering a gas limit, then operation simply will not be executed.

Ethereum network uses Proof-of-Work consensus building algorithm and will soon switch to the hybrid Proof-of-Work/Proof-of-Stake after implementing Casper protocol.

Casper is in development since 2014 and is a radical change in reaching of consensus in Ethereum network. The update is a combination of two research projects: Casper the Friendly Finality Gadget (FFG) and Casper the Friendly Ghost: Correct-by-Construction (CBC) headed by Vitalik Buterin and Vlad Zamfir respectively.

Casper Friendly Finality Gadget (FFG) is a hybrid consensus building mechanism PoW/PoS, which will help in the transition to PoS. The mechanism aims to protect Ethereum network from potential hackers, helping it to scale more efficiently and reduce its dependence on expensive electricity used in mining.

FFG (Friendly Finality Gadget) will not replace PoW, but will act as a step towards accepting PoS. This is achieved using an overlay that positions PoS mechanism over PoW chain. Thus, Casper FFG uses both PoW and PoS to check and create new blocks.

At the beginning stage of transition, Casper will save the current Ethereum PoW protocol to process most of the network requests and will use PoS only to periodically review “checkpoints”. In subsequent releases, PoS algorithm will take on a large workload, up to the full transition of hybrid consensus building algorithm into PoS system.

Version 0.1.0 of the code was announced on GitHub on May 8, 2018 by Danny Ryan. This release will allow auditors and developers of Ethereum clients to view the code and experiment with its integration into their software. Since Casper will not be compatible with earlier versions of Ethereum, the release gives clients of Ethereum software the ability to “track changes” and integrate updated scripts into their systems before the main hard fork.

After the end of hybrid period, ETH mining will be a thing of the past. To prevent dissatisfaction of miners and creating their own PoW fork, developers stated that they would lay a “difficulty bomb” in the PoW chain immediately after implementation of Casper: mining difficulty will be increasing exponentially until it becomes impossible.

In Ethereum developers describe business logic by creating smart contracts. Smart contracts are software entities that implement a specific sequence of steps. Every time they receive messages called transactions, contracts can save data, receive and send transactions, and interact with other contracts without human intervention. At the same time, the developer does not need an infrastructure for development and distribution, it is provided by Ethereum Virtual Machine.

Each contract in blockchain has a permanent address assigned to it at the time of creation and allowing it to be identified in the system. Each contract contains a balance, expressed as some amount of ETH. If the contract does not include any program instruction, it acts as an account that has an address and balance. Accounts can exchange tokens with other accounts or contracts. The execution of certain actions of the program is possible due to transferring parameters to program instructions methods. The execution of method can change the state of a contract by adjusting the values of one or more of its fields. A contract may also have a set of events used to notify interested parties about the results of particular events throughout the duration of the contract. By default, the life of any new contract in the system is unlimited. However, when creating a contract, its initiator may specify the possibility of self-destruction when, after a certain time or certain fulfilled conditions, the contract ceases to exist, and its entire balance is transferred to another account.

Ethereum uses several turing-complete programming languages for writing smart contracts: the main one is Solidity (language library similar to C and JavaScript), Serpent (Python analogue), LLL (low-level Lisp-like language) and Mutan. Due to the difficulty of perceiving smart contracts that are written in Solidity programming language, bugs and vulnerabilities have repeatedly appeared in contracts. For example, in 2017, the user devopps199 discovered a vulnerability in the smart contract where the second most popular eth-client was working, and accidentally froze over $100 million. After that, a team of researchers from the UK and Singapore found 34,200 critical vulnerabilities in 3,000 randomly selected contracts. Therefore, some developers suggest using a different, more accessible modular Vyper, the syntax of which is similar to Python. At the moment, the language is under development. Here are some key points of Vyper v0.1.0-beta.1 version: the absence of function overload, the presence of all constructions known to programmers, recursion exception and others.

In addition to virtual machine for executing contracts logic, Ethereum project also uses two additional protocols that implement the support for peer-to-peer messaging and static files (for more information, see Built-in mechanisms and functions section).

Example of performing transaction algorithm in Ethereum network using MyEtherWallet wallet:

Ethereum network resistance to basic attacks:

- DOS attack. In Ethereum network miners prefer to choose high-paid transactions in order to add them to blockchain. Since the network has ultimate bandwidth and computing power, a scenario can be imagined where many transactions with high commission are sent to the network, which actually blocks many legitimate transactions with a lower commission. It will be an expensive attack to perform in the network, but there are situations when there are financial incentives for this.

- 51% attack. The PoW algorithm is subject to 51% attacks, after which there are no effective recovery strategies. The more common the spread of blockchain (as in the case of Ethereum), the greater its total token generation power. However, theoretically, if someone captures a sufficient amount of hash power, he will be able to carry out the so-called 51% attack. Switching to PoS in the future will solve this problem.

- Double spend. It is possible for attacker to create a secret chain of blocks that is larger than the main one and to conduct a double spend attack. However, the more powerful the network, the more difficult it is to be done.

By the end of 2018, significant changes will be made on the platform, which should improve network performance:

- Sharding will allow to abandon full nodes and share the load between all shards (for more details, see Performance and Scalability section). However, introduction of sharding creates additional possible vulnerabilities in the system, since in this model some nodes have to turn to others for missing information and, thereafter, have to trust them. Ethereum developers plan to solve this problem by introducing economic incentives that will encourage system participants to act in a certain way — so that the nodes are interested to provide reliable information to other nodes.

- Casper (for more details, see Consensus Building Mechanisms section). After implementation of Casper protocol and transition to PoS, the network will be supported not by miners, but by nodes. It will take 32 ETH (initially this amount was 1500 ETH) to deploy a PoS-node. Alternatively, those who do not have so many tokens will be able to unite into PoS pools.

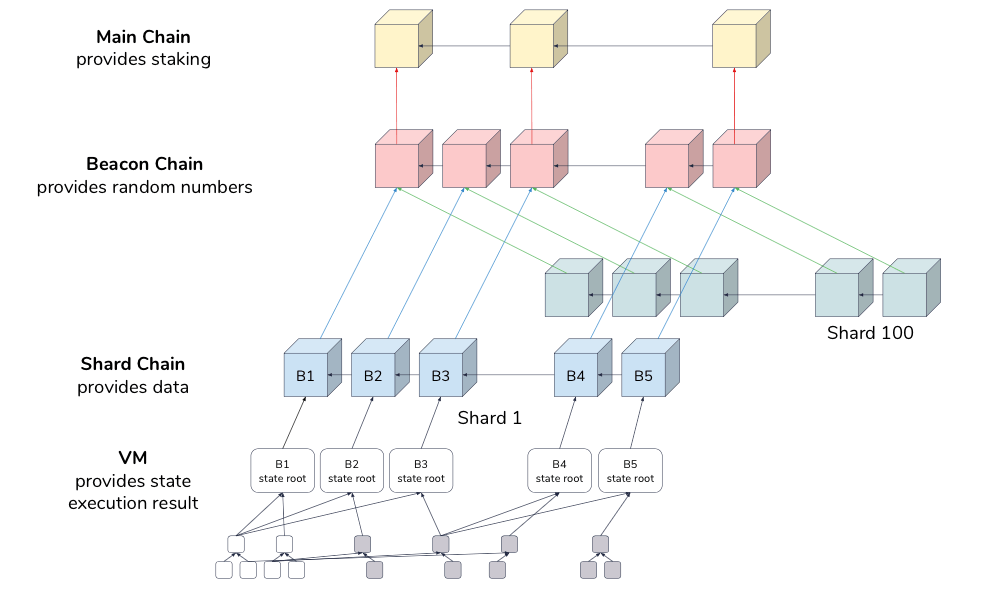

In the next few years, the following changes will occur in Ethereum architecture:

Yellow blocks are the current blockchain architecture, red blocks are the planned components in 2018–2019, grey and blue blocks are sharding in 2020, white blocks are plans for 2021.

Additional differences between the old and the new version of Ethereum are in the presentation.

Formal development of Ethereum software began in early 2014 through the Swiss company Ethereum Switzerland GmbH (EthSuisse). Subsequently, a non-profit foundation was created — Ethereum Foundation (Stiftung Ethereum), registered in Zug, Switzerland.

ETH token is a utility, which means it is not subject to SEC securities restrictions. The representative of SEC during Yahoo Finance summit in June 14, 2018 officially announced this.

Ethereum is a platform for developing applications by third-party projects, so no licenses are required for the work of the project.

1. "Architecture and Logic" evaluation: 8 points out of 10. The outlook is positive.

Mechanisms and principles of emission - 2 points out of 3 (unlimited emission, which entails problems with inflation).

Blockchain (architecture and consensus building mechanism) - 3 points out of 4 (the PoW algorithm has several disadvantages; the unpopular Solidity language is mainly used to develop smart contracts).

Licensing and legal aspects - 3 points out of 3.

The outlook is positive. Despite Ethereum current weaknesses, the platform has passed the test of time and the project developers learn from their mistakes. Upcoming changes on the platform are designed to eliminate the existing problems. It is necessary to monitor the timeliness and success of the implementation of changes on the platform.

In early tests of Ethereum network, the performance rate did not exceed 25 transactions per second, which can probably be increased to 50 or 100 transactions per second during optimization. However, with the load of real applications, the current Ethereum network performance limit is 15 transactions per second.

One of the challenges of scaling smart contracts is the need to store the current state of each account in blockchain network. From the social and technical points of view, scalability is a huge obstacle to further development of Ethereum. Along with the growth of the network, achieving consensus on making major changes will become increasingly difficult. Due to the great popularity, the blockchain has reached the level of full computing power, commissions for transactions have increased, introduction of the platform in various industries has led to operational problems.

In this regard, the project team is planning global changes in the platform to eliminate these problems. Co-founder of the platform, Joseph Lubin said, that in the new blockchain system, it will be possible to conduct hundreds of thousands of transactions this year (2018) and that new technologies will be added with on-side, side-, off-chain mechanisms that will provide network scalability.

The plans include implementation of sharding technology — the distribution of data between physical servers. Sharding assumes the rejection of full nodes, which must store information about the full state of the network and every transaction that occurs on blockchain. Instead, each node stores some subset of this information and confirms only transactions relating to this subset.

Also, to improve performance, it is planned to introduce Plasma technology, which operates similarly to Lightning Network, allowing Ethereum to efficiently process micropayments, creating small networks outside the main chain.

Vitalik Buterin at OmiseGO AMA session declared that the synergy of these two scaling solutions (Sharding and Plasma) could allow Ethereum network to process up to one million transactions per second.

The key innovation of this blockchain is Ethereum Virtual Machine. It allows to run any program, providing a sufficient amount of resources (CPU time and memory). Before Ethereum emergence, it was necessary to make the original blockchain for each new application, and Ethereum (and its followers) allows to develop thousands of different applications on one platform.

Ethereum network can be described as application-agnostic, that is, it is specifically designed as a neutral platform for all potential applications. Even very popular protocol usage patterns are intentionally not embedded in Ethereum. This approach reduces increasing of network, but, on the other hand, many different applications require code reuse. Efficiency for application developers could certainly be increased if some more general functions were provided by the platform itself.

As mentioned above, Ethereum allows developers to create and deploy decentralized applications. Decentralized application or Dapp serves a specific purpose. Any centralized services can be decentralized via blockchain. From the most obvious services, such as loans provided by banks, to intermediary services, such as notaries, voting systems and much more.

Ethereum can also be used to create decentralized autonomous organizations (DAO) without a manager. DAOs are controlled by software code, based on a set of smart Ethereum contracts. This code is intended to replace the rules and structure of a traditional organization. It eliminates the need for employees and centralized control. DAO belongs to everyone who buys its tokens. At the same time, such tokens are not equal to shares or property, but rather act simply as investments, which, however, give their holders voting rights.

Ethereum smart contracts are often used to create tokens by third-party projects. Such tokens have the so-called ERC-20 standard. This abbreviation stands for:

- ERC (Ethereum Request for Comments) — official protocol for making proposals for improving Ethereum network;

- 20 — unique identification number of the proposal.

Before emergence of ERC-20 standard, there were many compatibility problems between various forms of Ethereum tokens, each of which had an absolutely unique smart contract. In order for the exchange or wallet to support the token, its developers needed to write a completely new code each time. To solve this problem, a standard protocol was created for all tokens.

ERC-20 standard defines a set of rules that must be followed in order for the token to be accepted and to have the ability to interact with other tokens in the network. The tokens themselves are blockchain-assets that can have value, and can also be sent and received like any other cryptocurrency.

At first, ERC-20 was an unofficial agreement between developers, but now it is a standard. However, before ERC-20 became the standard, ERC-223 has appeared, which aims to improve ERC-20. Since the standards have been developed simultaneously for some time, some of the improvements from ERC-223 have been implemented in ERC-20. ERC-223 standard is backward compatible with ERC-20.

To date (September 2018), the differences between the standards are as follows:

- In ERC-20 it is possible to send tokens to the address of a smart contract, and not the user. At the same time, the sent tokens hang on the address of smart contract, and nothing can be done with them. ERC-223 solves this problem.

- In ERC-223 gas consumption is slightly reduced for requests.

There is also ERC-721 standard, which is used to create unique tokens: each token has its own 256-bit identifier. Such standard is used, for example, in CryptoKitties game, where each token corresponds to a cat of unique appearance. This standard is still rarely used, it can be used for collecting or to describe property rights.

The network uses zk-Snarks zero-knowledge proof algorithm, which provides application developers with a high level of confidentiality. This algorithm allows to see transactions to individual parties, making them closed to all others.

Examples of using Ethereum network:

- Creating own tokens and crowdfunding. Many blockchain startups use the capabilities of Ethereum, creating their own tokens for Presale and ICO first on Ethereum. After creating their own blockchain, they swap Ethereum based tokens to their own tokens, created on their platform

- Creating applications that now can not do without intermediaries (Ebay, Airbnb, Uber, etc.). The peer-to-peer network eliminates the need for such intermediaries, allowing users to communicate with each other directly, thus speeding up and cheapening this process.

- Financial instruments. Credit applications and not only: any user can issue their own shares, bonds, derivatives or contracts for price difference based on Ethereum.

- Payment system. ETH tokens, although they have utility nature and originally intended to pay for network services, are in fact actively used as a tool for transferring value due to the high popularity and usability of Ethereum blockchain.

Two additional protocols for exchanging messages and files are also implemented on Ethereum platform:

- Whisper — a peer-to-peer protocol for confidential messaging with a short lifespan. The message header (subject) in Whisper is hashed, and the messages themselves can be encrypted with keys in order to protect the data. Indirect support for wide and group broadcasting is included. Designed for a weak Internet channel and high data transfer delays. Provides the ability to use masks/filters for more efficient search for topics of interest (titles) without giving out their specific name.

- Swarm — a peer-to-peer file sharing protocol. Files are divided into parts stored on network nodes. To keep track of sent and received parts of files, nodes use a special accounting protocol, and the activity of nodes is paid by micropayments — a measure designed to encourage cooperation between them.

Ethereum blockchain platform was launched on July 30, 2015. On March 14, 2016, Ethereum emerged from the early alpha version of Frontier, in which developers did not guarantee security. The new (current) version of the protocol is called Homestead and also belongs to the earlier, but already stable version.

On July 20, 2016, forced hard fork of The DAO was made in the network (for more details, see Trust Index section).

The planned hard fork of Metropolis is designed to improve performance of the platform. It is divided into 2 stages: Byzantium and Constantinople.

On October 16, 2017, Byzantium fork occurred, making the following changes to the network:

- Increase of anonymity of the network, due to the use of zk-Snarks zero-knowledge proof algorithm.

- Reducing the reward for miners, but increasing the speed of blocks mining.

- Increasing the complexity of mining.

- Optimization of smart contracts.

Constantinople hard fork should have been produced before October 30, 2018, but is likely to be postponed. First, it will be launched in the Ropsten test network, which is close to the main one in its characteristics. But in Ropsten it is difficult to determine the block from which the activation of Constantinople will begin. It is expected that such block will be mined on October 9. As for the main network update, it should be expected in November-December, said Hudson Jameson, who heads the communications department at Ethereum. Constantinople must lead to a higher level of scalability before sharding and Casper are gradually implemented.

Ethereum clients

Geth — the first client that was launched in the Frontier release. It is being deployed by many users, and is a command line protocol interface.

The use of the client:

- API and interfaces;

- Command line options;

- Javascript console;

- RPC JSON Server;

- RPC JSON API;

- Dapp API web3 JavaScript library.

Independent developer Alexey Akhunov rewrote Geth. New software is called "Turbo Geth". With its help, the storage process of Ethereum network history by the nodes was optimized. The amount of memory required to launch a full node on the basis of Turbo Geth is approximately 252.11 GB, which is five times less than the requirements of the traditional Geth client.

About 70% of miners are accounted for Parity client. There are two types of clients:

- To raise the grid with selected nodes that have the rights to make changes to the blockchain (Proof of authority).

- Clients that work with Ethereum public nodes.

The author of this client is Gavin Wood, who worked for some time with Vitalik Buterin, and then devoted himself entirely to Ethcore project.

Ethereumj — Java client developed by the Hack.ether.camp team.

Mist — a browser with web3 library. Comes with Geth node. As soon as Mist launches, Geth starts its work at once.

MetaMask — a plugin for Chrome browser. Allows to launch Dapp, excluding the full node on the client. Full node communication via JSON RPC API. Implemented in JavaScript.

Wallets

Ethereum is one of the most popular blockchains, so there are a lot of wallets supporting the work with ETH tokens. The following are some of the most popular.

Ethereum Wallet — official wallet.

MyEtherWallet — a browser-based online wallet. The site is built in JavaScript and collects data on the client side, allows to create and use Ethereum-address for receiving and sending funds. In addition to ETH cryptocurrency, the presented wallet also supports tokens that are issued according to ERC-20 standard. In addition, there is the possibility of carrying out offline transactions, and Windows users are offered an extension for Chrome browser.

Initially launched as a Bitcoin wallet, Jaxx has added support for Ethereum some time later. It has the ability to link an existing account with several devices, since Jaxx is available not only in the desktop version for Windows, Linux and Mac, but also for mobile devices based on Android and iOS. Extensions for Chrome and FireFox browsers are also available.

EthAddress — built in JavaScript Ethereum wallet with client-side data collection. EthAddress is a paper wallets generator that supports several types of wallets, including brain wallets and collective wallets.

The wallets functions also have Mist and MetaMask mentioned above.

Other multicurrency wallets: Cryptonator, Coinbase, Exodus.

Hardware wallets with Ethereum support: Ledger Nano S, Trezor, KeepKey.

Ethereum has the possibility to implement callback functions in smart contract for calling from third-party applications.

Applications developed on Ethereum can be integrated into any project in any field of activity.

And the ERC20 token standard is the most popular and supported by all cryptocurrency exchanges.

2."Functionality and software platform" evaluation: 9 points out of 10. The outlook is positive.

Performance and scalability — 1 point out of 2 (low value).

Built-in mechanisms and functions - 3 points out of 3.

Product - 4 points out of 4.

Integration options - 1 point out of 1.

The outlook is positive. The project has a successfully working and actively developing product. At this stage of development Ethereum has low performance and scalability value. Planned for the near future changes in the network are designed to improve its work and eliminate existing shortcomings.

ETH token first appeared on the exchanges in August 2015. Now ETH can be bought on any cryptocurrency exchange.

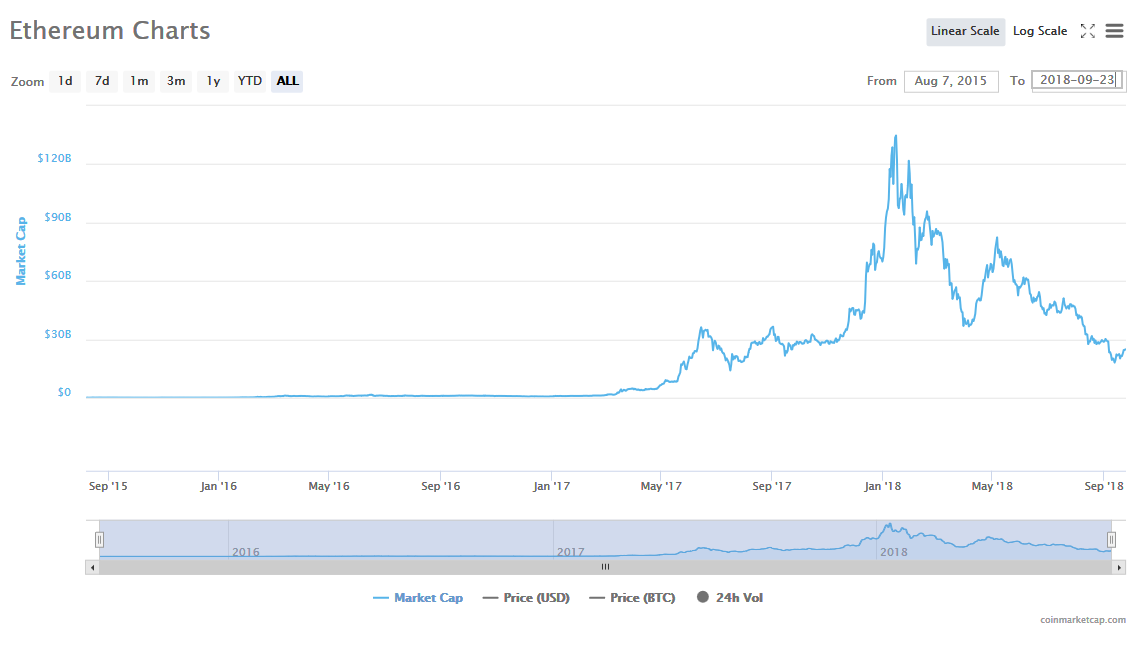

Against a background of growth of the entire cryptocurrency market, Ethereum’s total capitalization in January 2018 exceeded $100 billion, the historical maximum was reached on January 13, 2018 and amounted to $136 billion. But by August 2018, capitalization had already dropped to $30 billion. And on September 26, 2018, according to Coinmarketcap, it is almost $25 billion.

Ethereum solidly takes second place after Bitcoin in terms of capitalization in the general list of cryptocurrencies. On September 21, 2018, Ripple pushed it from this place, but Ethereum quickly regained its position.

Capitalization dynamics:

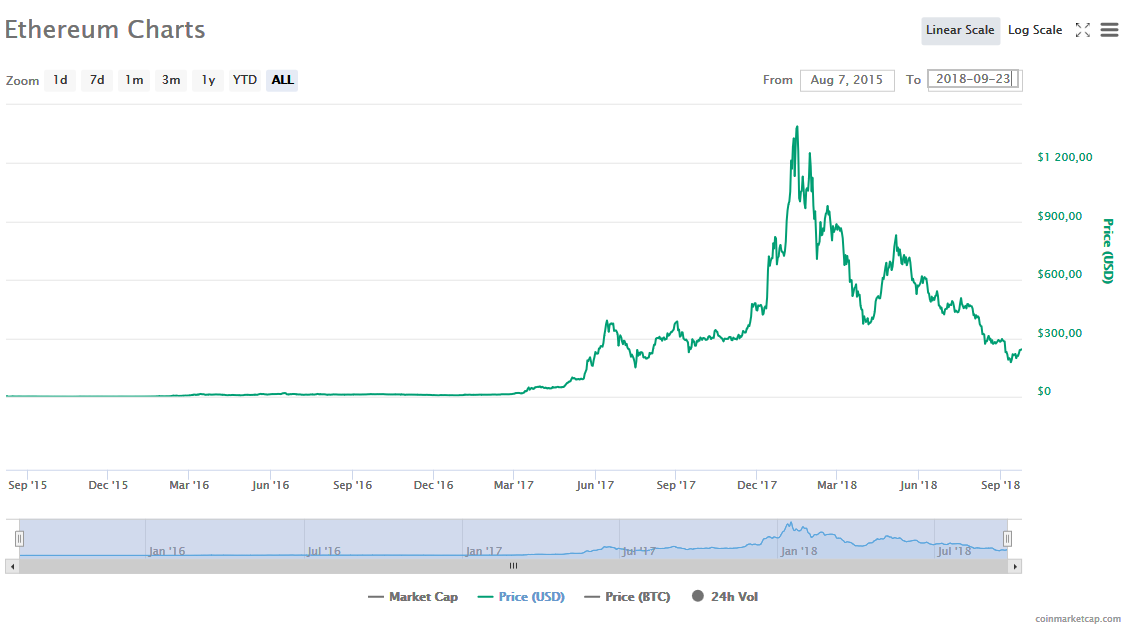

Token began to trade on exchange at a price of $3.51. The historical minimum of the price was recorded on October 22, 2015 — 42 cents.

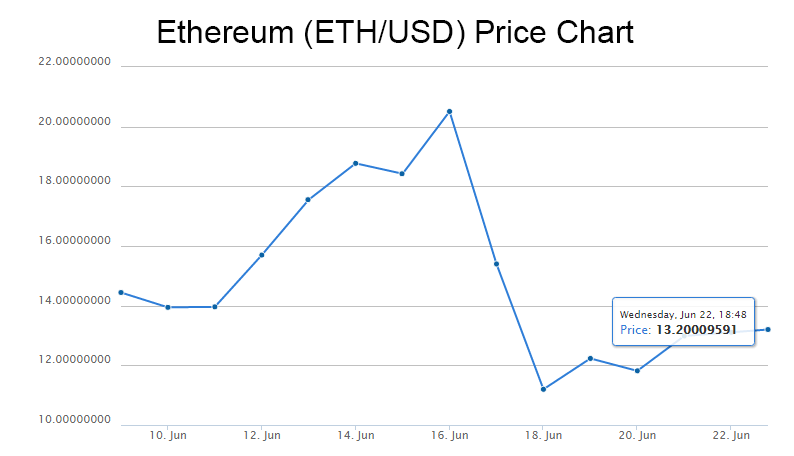

Then the rate was gradually increasing, not exceeding $20. One of the strong price drop of the token was associated with The DAO scandal (for more details, see Trust Index section). On June 18, 2016, ETH/USD rate fell by almost a third. First, the price fell from $20 to $15, and by the middle of July 2016 it fixed at $10.

From February to April 2017, Bitcoin went up from $975 to $1,400. Investors began to massively invest in cryptocurrency, which led to the emergence of numerous unconfirmed transactions. During this period, their number reached 100’000-200’000. Ethereum at that time was working properly, so many users saw in it an excellent alternative to Bitcoins. ETH/USD quotes rose first from $11 to $84, and in May 2017, they have broken through the level of $200.

In the summer of 2017, Bitcoin continued to rise in price and to fail from time to time. And Ethereum in this period overcame the mark of $400. In the winter of 2017-2018, the entire cryptocurrency market went up, including Ethereum. On January 15, 2018, the historical maximum price of the token was reached — $1’389.

As of September 26, 2018, according to Coinmarketcap, the price of ETH token is $244,21.

Bitcoin is not the only and not the main factor, due to which Ethereum could grow in value so quickly. Many companies around the world are actively interested in Ethereum platform and launch numerous blockchain applications on its base.

Token price dynamics:

There are forecasts of token price growth due to decrease in ETH offer on the market. For example, there are currently 102 million ETH in circulation. A part of these coins is on the wallets and does not enter exchanges. However, there is a certain amount that is used specifically for sale and speculation, and this amount is constantly changing hands. When the network moves to a new PoS consensus building algorithm, a part of ETH will be acquired and withdrawn from the market in order to be reserved in the nodes. In this way, all other things being equal, ETH will decline. In addition, emission will naturally be limited, since mining will become unavailable and the generation of new coins will cease.

3. "Statistics" evaluation: 8 points out of 10. The outlook is positive.

Distribution — 3 points out of 3.

Capitalization dynamics — 3 points out of 4 (dependence on market movement).

Token price dynamics — 2 points out of 3 (high volatility and dependence on market movement).

The outlook is positive. ETH token is the second most popular and is available on all known cryptocurrency exchanges. Like other cryptocurrencies, it highly depends on market movement and has high volatility. After the network update, an organic increase in the token price is predicted, as a result of restriction of supply and increased demand due to the need to ensure operation of the nodes. In addition, high popularity of the platform contributes to the price increase.

Ethereum White Paper is published on GitHub of the project. The document contains a technical description of the system, its architecture, scope, description of token economy. WP is regularly updated if necessary, the last update was made on August 22, 2018 (a total of 169 revisions were made).

Ethereum virtual machine is described in more detail in a separate document — Yellow Paper.

Also there is the project Wiki on GitHub where you can find more detailed information on various aspects and components of the system, including instructions for developers. Other additional documentation can be found on a separate site. There is also documentation for studying Solidity language.

The first Road Map, dated March 3, 2015, and posted on the official blog of the project, contains detailed description of the releases that are planned to be brought out for the development of the platform. The dates are not specified, but this is mainly due to the fact that bringing out each release is connected to mining a certain number of blocks, and it is difficult to predict the date of mining a certain block. So the timing of releases were appearing closer to their issue.

More information on research and development is available on:

- GitHub in the project Wiki (R&D section), the current roadmap can also be found there.

- Ethereum Research Forum.

Since the exact dates are not specified in the roadmap, it is hard to define a planning horizon. However, according to dynamics of releases, the planning horizon is at least 5 years.

4. "Analysis of Road Map and White Paper" evaluation: 9 points out of 10. The outlook is positive.

White Paper — 5 points out of 5.

Road Map — 4 points out of 5 (not in the form of a separate document on which it would be easy to follow the development of the platform).

The outlook is positive. High quality project documentation, not enough user-friendly interface for Road Map.

Team

The group of creators of Ethereum platform includes a large number of developers, engineers, analysts, including:

- Vitaly Buterin — creator and co-founder. He is also the general partner of Fenbushi Capital, he advises some companies that use blockchain technology, such as Kyber, Augur, WeTrust, Nuco and OmiseGo. Vitaly is one of three team members who form Ethereum Foundation managing group.

- Nick Johnson — a software engineer who played a significant role in platform development. Previously worked with Google, Lumi and other well-known technology companies.

- Jeffrey Wilke — another co-founder of Ethereum network and the leading developer of go-ethereum. He has experience in StudyFlow and other well-known technological organizations. He is one of three team members managing ETH Foundation.

- Min Chan — Executive Director of Ethereum Foundations. Previously, she worked as a consultant in large technology companies.

- Joseph Lubin — co-founder of Ethereum project. The founder of ConsenSys company, which is engaged in the creation of decentralized applications (DApps) in ETH network.

The project is developed and managed by Swiss non-profit organization — Ethereum Foundation, which unites experts from around the world.

Investors

At the start, Ethereum received a grant of $100’000 from The Thiel Fellowship, a foundation of Peter Thiel, who is the founder of PayPal and the first Facebook investor.

As Vitalik Buterin told in his interview to Forbes magazine: “We did not attract venture investments. Those who stood at the origins of Ethereum, wanted to develop the project according to all the rules of venture financing. But I was against it. I wanted the platform’s basic infrastructure to be created by a non-profit organization. Only in this way people would accept the idea of decentralization and independence of the system on which Ethereum is based. We are now working through Ethereum Foundation, it has no goal to earn.”

Partners

Enterprise Ethereum Alliance (EEA) was created in February 2017 to search for opportunities to use blockchain technology on Ethereum platform in real business. The alliance unites the largest international companies such as CME Group, Credit Suisse, DTCC, ING, JPMorgan, Santander, UBS, Accenture, Deloitte, Intel, Microsoft. The alliance also includes successful tech startups and research organizations.

5. "Analysis of the project team and affiliated persons" evaluation: 10 points out of 10. The outlook is positive.

The number of the team — 2 points out of 2.

Team structure — 3 points out of 3.

Team competencies — 3 points out of 3.

Affiliated persons — 2 points out of 2.

The outlook is positive. Numerous, highly qualified and experienced team, which consists of opinion leaders in the field of blockchain technologies, and who themselves are involved as advisors in other blockchain projects.

Although many users often compare Ethereum and Bitcoin with each other, the reality is that they are completely different projects and have different goals and perspectives. Bitcoin has become a relatively stable global digital currency, despite the high volatility, while Ethereum seeks to go beyond the next attempt to create an alternative to traditional money payment network. Its token is primarily not a trading tool for speculative purposes, but a component of intelligent contracts and platform applications.

Basically, any blockchain with the support of smart contracts is a competitor of Ethereum. “Ethereum killers” appear with enviable regularity. This title has already received: EOS, Tezos, Cardano, Codius, NEO. Also, should not forget about the fork — Ethereum Classic. Almost all of them have certain competitive advantages over Ethereum. For example, most have higher performance and scalability value. Ethereum cannot yet offer the level of privacy that Dash and Monero offer.

However, Ethereum still remains the industry leader. Having wide experience of successful work, wide distribution, highly qualified team that is constantly working to improve and develop the project, Ethereum does not give up its positions, eliminates existing shortcomings and, most likely, will not be pushed out from its second place soon. According to Vitalik Buterin: “ Ethereum killer is Ethereum 2.0”.

6. "Competitors" evaluation: 5 points out of 10. The outlook is positive.

Direct competitors - 2 points out of 4 (high competition).

Industry competitors - 2 points out of 4 (high competition).

Project monitoring of competition - 1 point out of 2 (in personal accounts of Vitalik Buterin an opinion about the emerging major competitive projects can be found).

The outlook is positive. Despite the high competition, Ethereum is a leader in its industry and is doing everything possible to keep it up.

Citation, social networks

Ethereum is one of the most popular blockchain projects in the world along with Bitcoin. Almost no news about cryptocurrency world is complete without mentioning Ethereum. According to Google AdWords and Wordstat Yandex, the word “ethereum” is requested up to 100 thousand times a month. According to CoinControl the project is mentioned in the news on average 70 times a day, and in social networks posts — 200 times.

The popularity of Ethereum accounts in social networks (on September 28, 2018):

- Reddit — 397’250 subscribers,

- Twitter — 430’048 followers,

- Facebook — 150’237 subscribers,

- YouTube — over 56’000 subscribers.

Over the past year, the audience of accounts on Reddit and Twitter has almost doubled, on Facebook it increased by half.

Applicability

The work of Ethereum network can be monitored in the explorer: https://etherscan.io/.

The total number of transactions in the network at the moment (September 28, 2018) is more than 316 million.

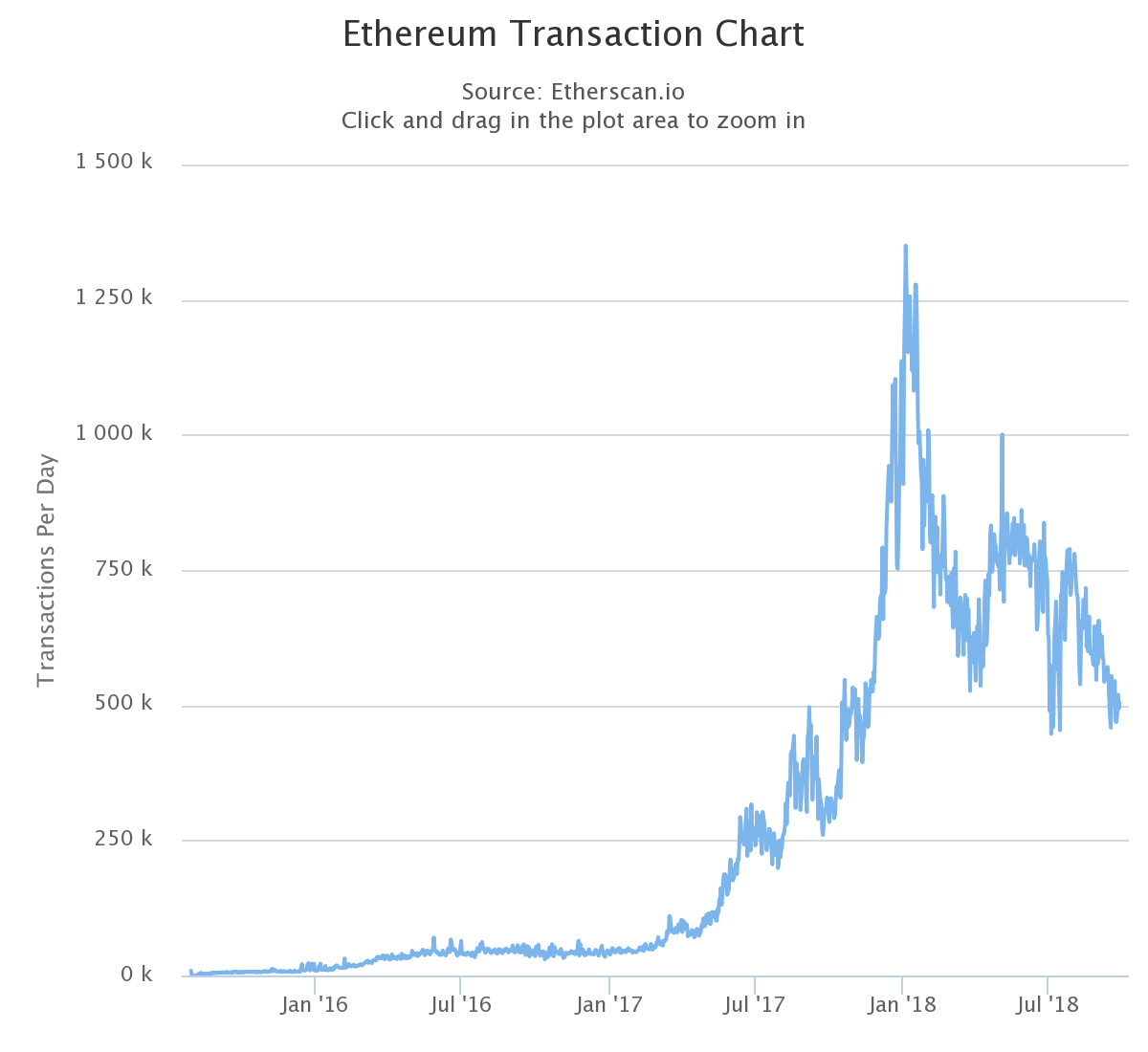

According to blocktivity.info, an average of about 506 thousand transactions are performed daily in Ethereum network, a record is 1'372’918 transactions in one day. Ethereum is in the top 5 blockchains for this indicator. Statistics on the number of transactions per day:

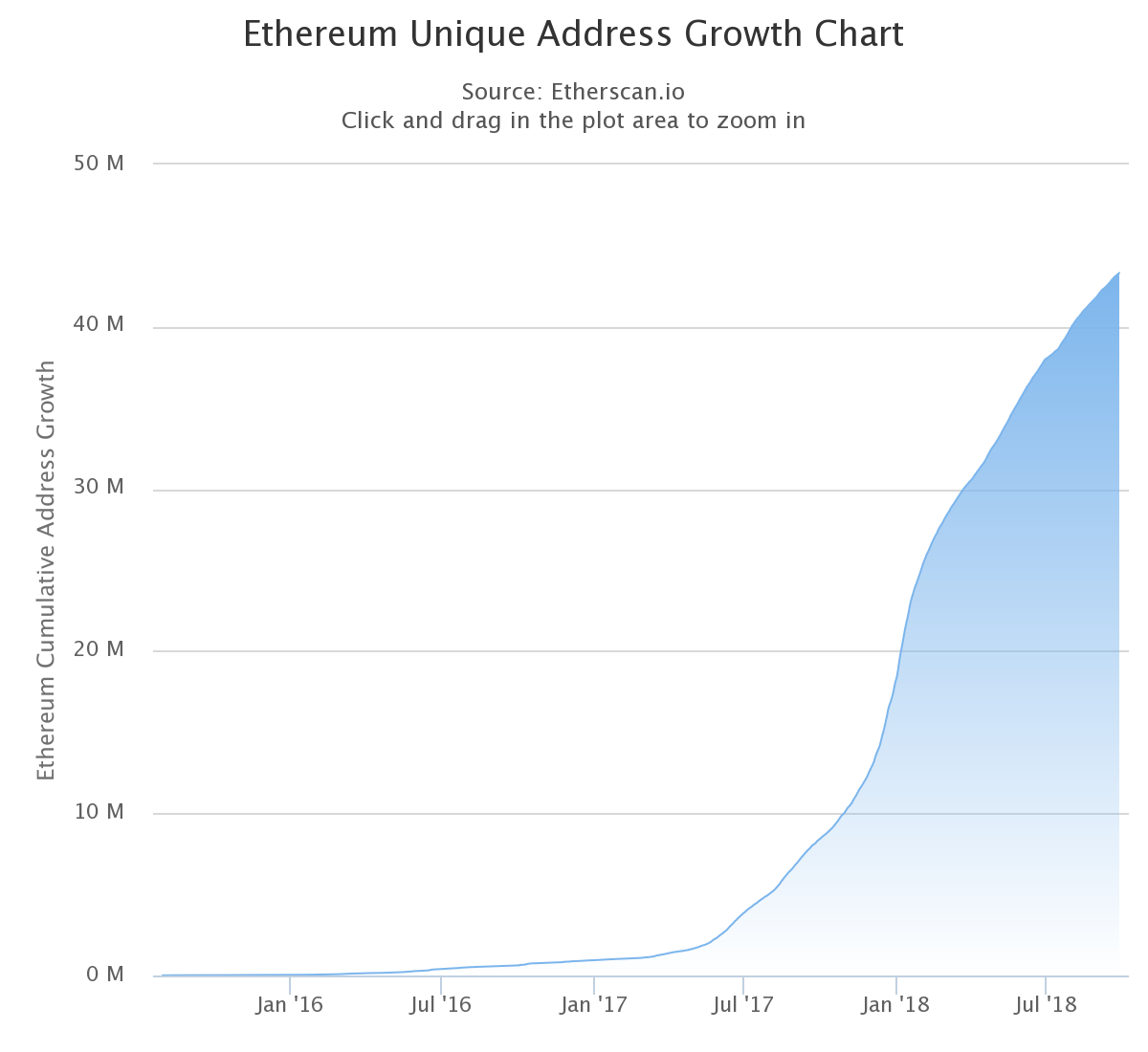

More than 43 million addresses are registered in the network. The record for the number of addresses registered in one day is 352’888, this happened on January 4, 2018. The graph of number of addresses growth:

Projects on technology

Enterprise Ethereum Alliance (EEA) unites major international companies such as CME Group, Credit Suisse, DTCC, ING, JPMorgan, Santander, UBS, Accenture, Deloitte, Intel, Microsoft. The alliance also includes successful tech startups and research organizations. EEA creates various Ethereum-based projects and develops innovative technologies.

In February 2018, the largest Ethereum projects — OmiseGo, Cosmos, Golem, VC Global Brain, Maker and Raiden — united to support startups being developed on Ethereum blockchain. The union was named Ethereum Community Fund (ECF) and allocated more than $100 million to support projects that are promising for Ethereum crypto community. The Fund plans to launch grant program that will provide ongoing financial support to selected startups. Currently, ECF does not provide accurate data on the size of grants, but according to some sources they can range from $50 thousand to $500 thousand with the possibility of subsequent funding to ensure the progress. In official press release it is reported that the Fund can also support any other companies at its discretion.

Due to the widespread use of ERC-20 standard tokens, many projects release tokens of this particular standard; if the project provides developing of its own blockchain, then after launching the main network, these tokens are changed to platform's own tokens. Some of the largest projects that have released Ethereum tokens:

- EOS — a platform for working with decentralized applications.

- TRON — a project that creates an international free entertainment platform.

- ICON — a platform for uniting blockchains into a single network.

- Binance Coin — a native token of Binance, a major cryptocurrency exchange.

- OmiseGo — a project for combining currency exchange and payment services in real time between different jurisdictions and organizational repositories.

- Augur — a project that aims to create the first decentralized forecast market.

- Golem plans to create a global, open, decentralized supercomputer that anyone with Internet access can use.

- DigixDAO — a decentralized autonomous organization (DAO). It controls Digix ecosystem that provides the ability to tokenize and document the assets of the physical world.

This is not all the projects, new ones appear daily, it is difficult to count them all. State of the dApps project collects information about decentralized Ethereum based applications. At the moment this list has 1933 applications.

Some of these applications are:

- FOAM mapping application. Users register points on FOAM map using a cryptographic method called Proof-of-Location.

- Weifund — an open platform used to collect money. Contributions are converted into digital assets, and they can be used within Ethereum network.

- Uport — a storage of personal information, where user can control by himself who can get access to his data and who cannot. This precludes the use of personal information by third parties.

- Provenance project uses Ethereum to make the supply chain more open and transparent. The purpose of this system is to enable the consumer to make more informed decisions at the stage of purchasing goods and organizing their delivery.

- Etheria is an analogue of Minecraft — users can create virtual worlds in which players own individual cells ("tiles") and can build on them various objects from blocks. According to the information on the site, all actions in the virtual universe are based on Ethereum platform.

- KYC-Chain — a system of customer identification, based on Ethereum, will allow to identify users in various fields: insurance, finance, notarial certificates, and so on.

- 4G Capital provides access to crediting for small businesses in Africa. The company has developed a decentralized application that allows businesses in Kenya to be funded with the use of digital currency.

- Ampliative Art implements a platform where representatives of creative professions and art communities can publish their content and receive rewards from users in alternative currencies.

Famous persons in the team

The creators of the project are the most famous people in the world of blockchain technologies. In particular, Vitalik Buterin is an opinion leader in the industry, he is attracted by startups as an adviser, and regulators — as a consultant.

7. “Fame of the project” evaluation: 10 points out of 10. The outlook is positive.

Citation, social networks — 3 points out of 3.

Applicability / distribution — 2 points out of 2.

Projects based on technology - 3 points out of 3.

Famous persons in the team - 2 points out of 2.

The outlook is positive. The most famous and popular project along with Bitcoin.

In June 2016, an error was detected in the software code of The DAO, a platform for autonomous investment capital management based on Ethereum. This project was developed by the creators of Slock.it startup, its launch took place on April 30, 2016. The innovative idea of the project attracted a large number of investors, the amount collected on ICO amounted to more than $100 million.

On June 16, 2016, unknown persons transferred about a third of the tokens in The DAO (at the rate on that time it was about $50 million) to the addresses of ChildDAO, which was controlled only by the attacking side. The attacker has created a cyclic program that allows to form subsidiaries of the main DAO. This action, written in the code, was encouraged by tokens. As a result of cyclicity, tokens moved to the unknown owner of millions of fictitious subsidiaries. However, thanks to the features of implementation of The DAO, these funds were not available for withdrawal within a month.

The founder of Ethereum, Vitalik Buterin, immediately after the attack, asked to suspend operations of withdrawing funds through exchanges from ETH in dollars and BTC. At the same time, the proposal to suspend affected all transactions, even those not related to The DAO, which was perceived ambiguously.

There were 3 ways out from the current situation:

- Soft fork, intended to limit operations from the hacker's wallet, but at the same time the money will remain frozen with him.

- Hard fork can cancel all illegal transactions and return the funds to The DAO tokens owners.

- Do nothing, leave all funds on the attacker account.

Choosing one of the first two solutions meant creating a precedent for intervention in an open system controlled solely by code, and harming the ideology of DAO itself. Moreover, if The DAO code permits such transaction, then according to the rules of organization, what does not contradict the code — is legitimate. The choice of the third option meant the occurrence of reasonable claims from investors whose funds were stolen.

After several weeks of discussion, on July 20, 2016, a hard fork was made on Ethereum project to cancel the hack and return to investors the funds stolen from The DAO.

As a result of rejection of the rollback of transaction history and the change in the rules by community, Ethereum Classic was formed.

This situation had a negative impact not only on Ethereum, but also on the whole blockchain ideology. However, the prophecies about the death of blockchain in general and Ethereum in particular did not come true, and after a rapid fall, ETH rate resumed its growth again in a couple of days:

According to independent experts, the developers reacted very quickly to the hacking of the project and began to offer both technical and ethical alternative solutions to this situation.

In 2017, users of Parity online wallet underwent two attacks at once. In July, attackers stole more than 153’000 ETH from users’ accounts, which amounted to $30 million. For the attack hackers used an error in the code of one of the smart contracts. A few months later, many Parity users faced serious problems again. This time, due to another mistake in smart contract, tokens amounted to more than $150 million were frozen.

The vulnerability of smart contracts is a major concern for the crypto community. According to many experts, developers of the protocol should review the attitude to the system security and tighten the rules for writing the code. At the moment, stability of smart contract depends solely on the developer’s professionalism and his ability to provide non-standard cases of program behavior.

8. “Trust index” evaluation: 8 points out of 10. Probability of scam: low.

Scam probability is low. Ethereum is one of the most trustworthy blockchain projects. It has a long period of work. The project team solves promptly the problems which arise in the network, without prejudice to the interests of investors. However, there is a risk for users, associated with vulnerability of smart contracts. And although the stability of smart contract depends on the professionalism of the developer who writes it, the project team does not show enough activity to improve the security of the system.

RATING. “Ethereum” evaluation: 67 points out of 80 - 83.75%. The outlook is positive.

The outlook is positive. Ethereum is one of the most common and popular blockchains. A strong and experienced team is constantly working to improve the platform. Despite the increasing competition in the industry, the project confidently holds the leading position. Future changes (sharding and Casper protocol) are designed to eliminate the problems for which Ethereum is now being criticized — low performance and scalability.

At the moment, Ethereum is firmly fixed in the top of cryptocurrencies and is one of the most used platforms. And its popularity is only growing. Ethereum has many positive reviews. The work to solve security problems, as well as increasing the bandwidth and cost of network operation is in progress. Despite the emergence of strong competitors, it is very likely that Ethereum will retain its leading position next year.

Advantages:

- Wide availability, distribution of token on all trading platforms. The real business begins to use Bitcoin and Ethereum in the first place for implementation of cryptocurrency in its activities.

- Possibility of mining.

- Support of multiple programming languages.

- Strong reputation of the project and its team.

- Interest from large corporations: Cisco, MasterCard, Intel and other companies united into Enterprise Ethereum Alliance

Disadvantages:

- The complication of mining and its early rejection. The announcement of transition to the PoS algorithm caused dissatisfaction with many miners who invested money in equipment for Ether mining.

- The influence of human factor: mistakes in writing smart contracts can lead to losses amounting to tens of millions of dollars (the attack of The DAO and Parity).

- Low performance and scalability. These shortcomings should soon be eliminated.

- Growing competition.

References

Official website — https://ethereum.org/

Block explorer — https://etherscan.io/

Forum — https://forum.ethereum.org/

Blog — https://blog.ethereum.org/

GitHub — https://github.com/ethereum

Twitter — https://twitter.com/ethereum

Reddit — https://www.reddit.com/r/ethereum

Facebook — https://www.facebook.com/ethereumproject

YouTube — https://www.youtube.com/user/ethereumproject

Ethereum foundation — https://www.ethereum.org/foundation