Binance Coin is a native token of the Binance cryptocurrency exchange.

Binance Exchange (Binary + Finance = Binance) — one of the largest cryptocurrency exchanges, whose daily trading volumes are estimated at several billion dollars. Despite the fact that the launch of the exchange took place relatively recently, in July 2017, by April 27, 2018, according to the coinmarketcap, the exchange is on the second place in the daily trading volume, and it has repeatedly ranked first in this list. The Binance exchange operates only with cryptocurrencies, the fiat currencies are not represented on it and will not be.

Simultaneously with the launch of the Binance exchange, the ICO was launched, during which BNB tokens of the Ethereum ERC20 standard were distributed. These tokens are mainly used to pay exchange commissions. In addition, during the first 4 years there will be given discounts with the payment of commissions in the BNB.

ICO Binance successfully took place on July 3, 2017 and ended in a few minutes: about $ 15 million was collected in BTC and ETH.

200'000'000 BNB was issued. There will be no additional emission.

BNB tokens are ERC20 standard tokens, issued on the basis of Ethereum.

The cost of the BNB tokens during the ICO was to vary as follows:

- 1 week: 1ETH = 2700 BNB;

- 1 week: 1ETH = 2500 BNB;

- 1 week: 1ETH = 2300 BNB.

The cost in BTC was calculated based on its market value.

As stated above, the ICO ended on the first day.

The allocation of tokens is as follows:

- 100'000'000 BNB (50%) — ICO;

- 80'000'000 BNB (40%) — to the founders;

- 20'000'000 BNB (10%) — to early investors.

The plan of payments of collected funds to the team:

- 20% (16 million) initial payment.

- 20% (16 million) in 1 year.

- 20% (16 million) in 2 years.

- 20% (16 million) in 3 years.

- 20% (16 million) in 4 years.

The allocation of use of collected funds:

- 35% for the creation of the Binance platform and its modernization, including recruiting, training, development.

- 50% for branding and marketing.

- 15% reserve funds, which will be used in case of unforeseen situations.

To support the cost of the BNB tokens, the team provides for a reverse tokens buy-back: every quarter the team will use 20% of the profit to buy the BNB tokens and destroy them until 100'000'000 BNB is redeemed (50% of the initial release). All transactions for the redemption of tokens are fixed in the blockchain and can be checked.

Held tokens "burning":

- October 18, 2017. 986'000 BNB were burned.

- January 15, 2018. 1,821,586 BNB were burned.

- April 15, 2018. 2,220,314 BNB were burned.

By April 27, 2018, there are 194,972,068 BNBs.

The next planned redemption and destruction of tokens will take place on July 15, 2018.

Using BNB tokens

BNB tokens can be used to pay for services on the platform. Based on the White Paper of the project, the use includes, but is not limited by (possibly with the expansion of the platform, new uses of tokens will appear):

- exchange commission;

- withdrawal commission;

- listing fee;

- any other fee.

It is worth noting that the Binance exchange enables ICO to be held directly on the exchange. In this case, users can buy the project tokens, launched on the ICO, with the BNB platform tokens. For example, the TRON project conducted an ICO using Binance.

In addition, when paying commissions in BNB tokens, discounts are provided:

- 50% within 1st year;

- 25% within 2nd year;

- 12.5% within 3rd year;

- 6.75% within 4th year;

- further without discounts.

To maintain the BNB token cost, taking into account the reduction in the discount amount, the burning of the tokens described above is provided.

The current version of the BNB tokens is released on the basis of Ethereum, therefore, the mechanism for ensuring consensus is Proof of Work.

In the Ethereum blockchain, the Casper protocol is planned to be implemented in the future and the transition to Proof of Stake.

Currently, the BNB token operates within the Binance exchange and is an ERC20 standard token of the Ethereum blockchain; thus, it works on the basis of its architecture.

It should be noted that in March 2018, Binance announced the beginning of the development of its own blockchain — Binance Chain. Representatives of the team believe that soon the centralized and decentralized exchange platforms will coexist, complementing each other and having interrelations. Binance Chain will be a public blockchain, focused on the transfer and trade of decentralized assets. Back in the original White Paper it was said about the plan to create a decentralized platform in the future and now, six months later, during which Binance became one of the most popular cryptocurrency exchanges, the team confirmed its intentions.

The architectural features of the future blockchain are not yet disclosed, only that it will be public, and that the BNB tokens will function on its basis. It is not completely clear yet how the re-issue will be effected. A "token swap" is likely to be executed, in which the owners of the BNB tokens of the ERC20 standard will be credited with the tokens of the main Binance Chain. BNB tokens will be the main native token and should become an analog of gas in Ethereum to perform transactions. At the same time, Binance will have to transform from the company into a community.

Initially, Binance was registered in the jurisdiction of China, but after the authorities tightening on cryptocurrency transactions, the company changed its jurisdiction and moved the company's offices to Hong Kong.

However, in February 2018, Binance received a warning from the Securities and Futures Commission in which it ordered seven cryptocurrency exchanges, including Binance, to withdraw tokens from the trades that fall under the definition of securities.

After that, at the end of March, the Financial Services Agency of Japan has issued a warning to Binance about the need to terminate the exchange in Japan without a license from the FSA. Trade on Binance is possible without an identification procedure, but since the end of January there is a ban on anonymous trading in Japan.

CEO of Binance noted that the company was negotiating with the above regulators, but despite this, warnings were received.

After that, official reports that Binance plans to open offices in Malta appeared. The Government of Malta published in April 2018 «Draft of a national strategy to promote bitcoin and distributed ledger technology." The country plans to become the center of innovative blockchain companies and one of the first countries where bitcoin and related technologies will be legalized.

The exchange does not require a mandatory KYC procedure, however in this case the user will be limited to 2 BTC for withdrawal within 24 hours. To increase the limit to 100 BTC for a day, it is necessary to undergo the KYC procedure. It should be noted once again that only cryptocurrencies are represented on the stock exchange, and that the fiat currencies will not be represented.

Crowd sale was conducted using three platforms:

- 20'000'000 BNB on the btc9.com platform;

- 20'000'000 BNB on the RenRenICO platform;

- 60'000'000 BNB on the official website of Binance.com.

Information on KYC / AML procedures during the ICO is not available.

According to the Howey test, it is unlikely that BNB token can be considered a security paper, since it does not match the test parameters: there is a fact of investing, investment is made in a general enterprise, it is expected to receive profit as a result of the activities of third parties.

- "Architecture and Logic" evaluation: 7 points out of 10. The outlook is neutral.

The mechanism and emission principles – 1 point out of 3 (half of the tokens belong to the team).

Blockchain (architecture and consensus building mechanism) – 4 points out of 4.

Licensing and legal aspects – 2 points out of 3 (problems with regulators).

The outlook is neutral. The project is implemented on the basis of proven technology Ethereum. The command specifies distribution of BNB tokens, but half of BNB belongs to the team. Taking into account the prospect of developing the own blockchain and transferring the BNB tokens on its basis, it is worthwhile to monitor the appearance of information on this topic.

The basic technology Ethereum has low to date performance and scalability. The number of transactions per second is 10 - 100 (TPS). The average value is between 15 - 25.

The developers of Ethereum plan to embed new technologies designed to significantly improve these figures, but there are no exact timestamps yet.

Since Binance announced the development of its own blockchain, Binance Chain, and the reissue of native BNB tokens, which will function on its basis, performance and scalability will depend on the technology being developed. At the moment the technical details as well as the future blockchain launch dates are unknown.

In the context of the performance of the exchange itself, Binance is capable of handling 1'400'000 orders per second.

The main functions of the BNB token are linked to the Binance exchange:

- Commissions payments for operations on exchange, withdrawal of funds, listing of token, etc.

- The opportunity to participate in the ICO, conducted on the platform, by purchasing crowdsale tokens for BNB tokens.

On April 23, 2018, a mechanism was launched by which users of the Binance exchange can convert "crypto dust" into BNB tokens. Crypto dust is such a little amount of cryptocurrency that it can not be spent: their amount is less than the commission for the transaction. Now, Binance users can convert these balances to BNB tokens by simply clicking a button in their account.

Since the BNB tokens are ERC20 standard tokens, any wallets that support this standard can be used to store and transfer them.

One of the most common wallets is the online wallet — MyEtherWallet.

Binance exchange can be used with the official website, mobile applications for iOS and Android or desktop clients for macOS and Windows. Users have to monitor the applications updates, which are reported on the official website. Also, users need to remember that there are phishing sites and check the exchange website address.

Users note the convenience of the Binance exchange interface.

At this stage, the basis for easy integration of the BNB token is its ERC20 standard, which makes it compatible with decentralized applications on Ethereum.

Third-party projects also embed the option of paying for services in BNB tokens, for example, a decentralized mobile network Qlink announced a partnership with Binance, which will use the BNB tokens to pay for services in their application.

- "Functional and software platform" evaluation: 9 points out of 10. The outlook is positive.

The mechanism and emission principles – 1 point out of 3 (half of the tokens belong to the team).

Performance and scalability – 1 point out of 2 (low Ethereum value with a high value of Binance exchange).

Built-in mechanisms and functions – 3 points out of 3.

Product – 4 points out of 4.

Integration options – 1 point out of 1.

The outlook is positive. Although the BNB tokens have a small number of possibility of using, they correspond to all the original promises of the team, and the opportunities are gradually expanding. It can be expected that in the future the team will expand the capabilities of the BNB tokens.

Almost 100% of the trading volume of the BNB tokens belongs to its "home" platform Binance. According to coinmarketcap on April 28, 2018, 0.01% of the trades belong to the Bancor platform. According to coinhills, the token is also represented on the EtherDelta and Abucoins platforma. But the trading volumes on these platforms are negligible.

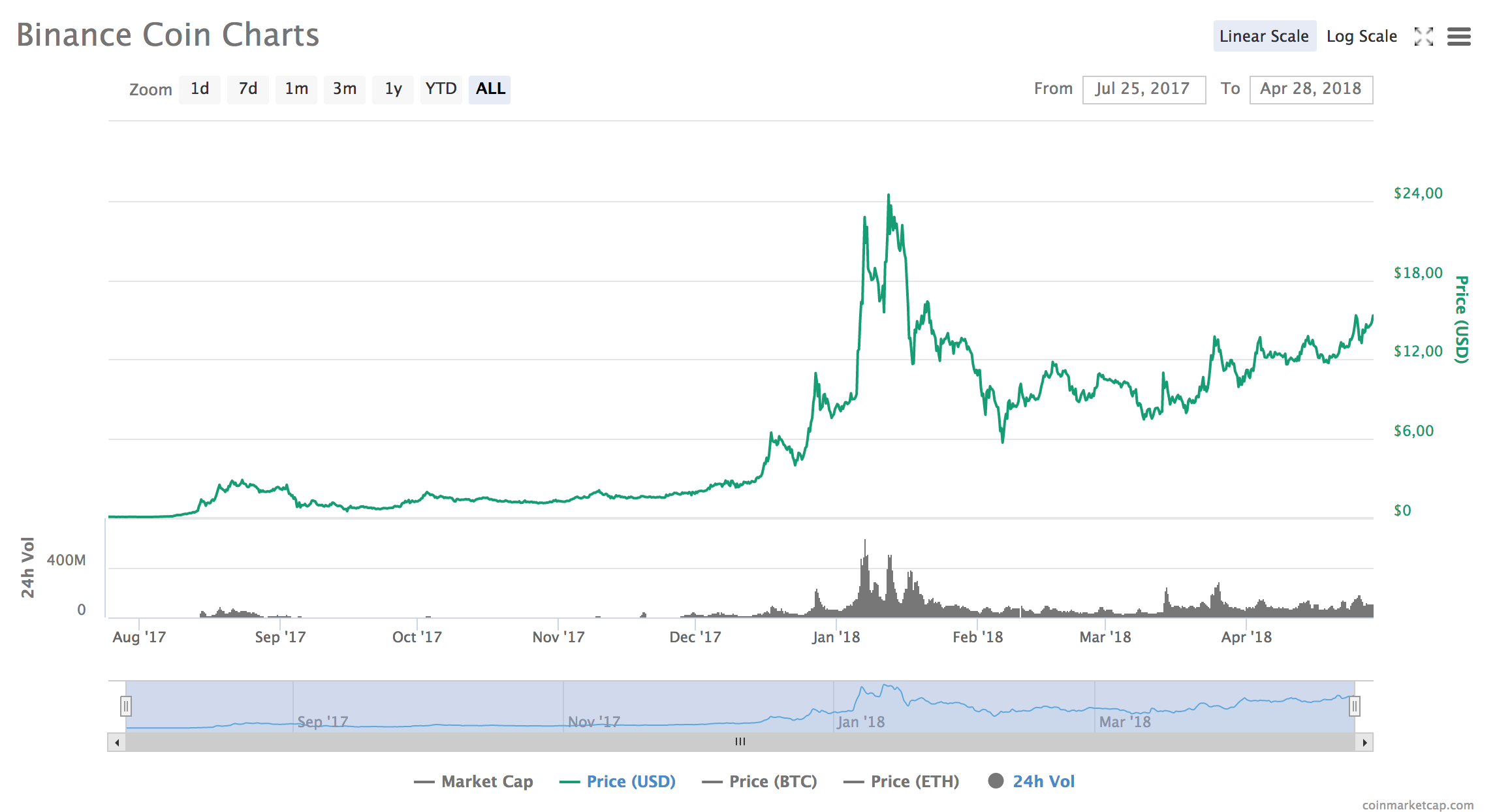

Since the emergence in July 2017 to the present day (April 28, 2018), the value of the BNB token has increased by more than 130 times. On April 28, 2018, according to coinmarketcap, the token cost was $15.30. In the autumn of 2017, it was fairly stable, then in December a rapid growth began, correlating with the general rise of the market. The maximum rate was reached on January 12: 1 BNB = $24.71. After reaching a peak value till February 6 there was a significant cost drop, which correlates with the overall dynamics of the cryptocurrency market. After the correction has began and a gradual step-by-step increase in the token cost. It is worth noting that there is no clear correlation in the short run between the cost drop of the token and a scheduled burning (once a quarter: October 18, January 15, April 15). It can also be noted that the team announcement about the development of its own blockchain — Binance Chain on March 13, 2018 positively affected the value of BNB. Taken one with another, excluding periods of increased volatility, the dynamics are positive.

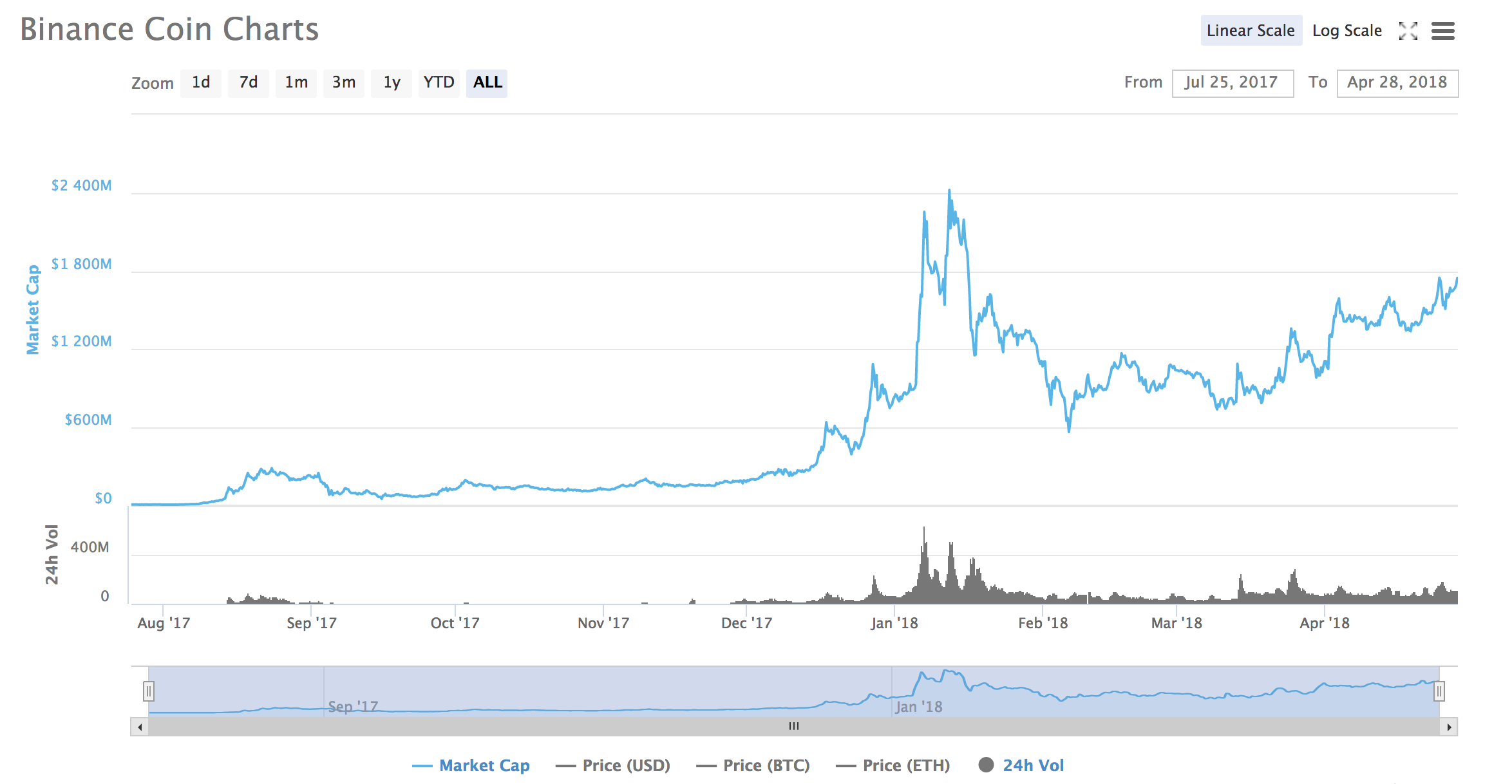

On April 28, 2018, according to coinmarketcap, the Binance Coin (BNB) tokens are on the 21st place by the capitalization of the cryptocurrency: $1'744'603'656 / 185'769 BTC. Capitalization maximum was reached on January 12, 2018: $2’446'626'038.

Taking into account the trades of BNB tokens at one platform, this is really an interesting case of achieving such a capitalization in short terms.

In the long term, it is interesting to observe the capitalization considering the interaction of several factors: quarterly burnings, annual unlock of team tokens, increase in value.

For a while, there was skepticism about the issuance of its own cryptocurrency by the exchange, since users believe that this gives owners the opportunity to manipulate the exchange rate. However, the funds distributed to the team are stored in reserve using a smart contract, and the team did not sell tokens to suppress the cost. In addition, the team quarterly buys tokens, corresponding to 20% of the company's profits for this period. If the cost of the token is high, a smaller number of tokens will be redeemed, respectively, the motivation to suppress the rate is reduced. Despite the criticism in the beginning, the attitude towards the Binance Coin token has mainly changed to a positive one.

- "Statistics" evaluation: 6 points out of 10. The outlook is neutral.

Distribution - 1 point out of 3 (on the one hand, it is logical that the "subsidiary" BNB token is listed on the Binance exchange, on the other hand, the absence of listing on other popular platforms can be perceived negatively and hinder the spread).

Capitalization dynamics - 3 points out of 4 (despite periods of increased volatility, there is an increase in capitalization, especially, taking into account the listing on one base platform).

Price dynamics of tokens - 2 points out of 3 (there is a dependence on the movements of the market).

The outlook is neutral. The project exists comparatively recently and demonstrates an unstable but growing token price. It is worthwhile to observe the further development and correlation between quarterly burning of the tokens, the unlocking of the team tokens, the reduction of the discount for using BNB to pay commissions.

The White Paper of the Binance Exchange is laconic, but it contains the essential information: the main advantages of the exchange, the description of the ICO, the description of the team, the potential risks.

There is no technical description of the work of the exchange in the document. Perhaps this is done to preserve the technologies that allow to provide high performance indicators, etc.

There is no Rad Map for the project, but the launch of the platform took place simultaneously with the ICO, and Road Map is typical for projects under development. White Paper notes plans to create a decentralized exchange and establish margin trading. And if the March statement on the development of the blockchain confirmed the intentions, then on the second point there is no information.

In the official team blog you can follow the development of Binance on weekly reports. Updates include the listing of new tokens, updates of the basic user software, and so on.

- "Analysis of Road Map and White Paper" evaluation: 4 points out of 10. The outlook is neutral.

White paper - 4 points out of 5.

Road map - 0 points out of 5 (small planning horizon, weak detailing).

The outlook is neutral. The outlook is neutral. Despite the low overall score, the project is significantly different from most going to the ICO. The team demonstrates active work on the project, actively keeps a blog. But considering the possibility of creating the own blockchain and the fact of the emergence of new opportunities for the BNB token, it would be helpful to have tools to evaluate the team's plans for further development.

The Binance exchange and, accordingly, the Binance Coin (BNB) token are under the control of a strong team:

- Changpeng Zhao (known as CZ) is the founder and CEO. He held the post of CTO and was a co-founder of OKCoin, the famous crypto exchange. He was the founder and CEO of BijieTech, which provides cloud services for exchange operators and cooperates with 30+ exchange platforms in Asia. At the end of the ICO, CZ left the management responsibilities of this company, remaining a shareholder, and switched completely to Binance. This also applies to all team members working at BijieTech. Before joining OKCoin, he headed the technical department of Blockchain.info, and developed this product together with Ben Reeves, Roger Ver, Anthony Antonopoulos and Nicolas Cary. Before that, in 2005, he co-founded Fusion Systems Ltd, a company specializing in low-delay trading systems for brokers. Prior to that, he headed the technical direction in Bloomberg Tradebook Futures during 4 years.

- Roger Wang — co-founder and CTO. He has more than 10 years of experience in the financial industry, leading technical teams, designing a high-level architecture of exchange and clearing systems, ensuring their security and stability. Prior to joining BijieTech he worked for Nomura Securities, Japan's largest investment bank, where he was responsible for credit and analytical systems, markings systems, that supported the many thousands of traders and analysts. Prior to this, he headed the technical direction of Morgan Stanley, where he specialized in developing systems that allow a large number of users to conduct data analysis and their modeling on-line, and in developing algorithms with low latency.

- James Hofbauer — Chief Architect. James was co-founded and Chief Architect in BijieTech. He is engaged in the development of the platform core architecture and middleware. Before joining BijieTech he worked in Palantir (Silicon Valley), a company that focuses on Big Data analyzing. High-performance Palantir systems are used in the areas of cybersecurity, fraud detection, the fight against terrorism and laundering of money, and so on, both by the private and public sectors. Before that he worked at Fusion Systems.

- Paul Jankunas — VP of Engineering. Paul was VP of Engineering at BijieTech. He has 15+ years of experience in developing software for exchange systems and financial applications for trading. Before that he worked in SBI BITS (Tokyo), the company that offers a variety of financial services, where he was responsible for developing the server and client side of trading applications. Before that he worked in Fusions Systems and Bloomberg.

- Allan Yan — Product Director. Allan was co-founder and Product Director at BijieTech. He has 10+ years experience in product development, UX, trading. In Bijie Tech he embeds innovations in the exchange systems, taking the product out in a highly competitive area. Prior to that, he worked for Orient International Holding, a large import / export company in Shanghai, where he was involved in the implementation of information systems.

- Sunny Li — Operations Director. Sunny was a co-founder and Operations Director at BijieTech. He has extensive experience in management, technical consulting and risk management. Before that he worked as a senior consultant in Accenture, where he provided IT and strategic consulting to large companies.

In August, it became known that Yi He — bitcoin evangelist, co-founder of the OKCoin exchange and one of the most famous persons in the Internet industry of China has joined the team. The community reacted positively to this news, which even reflected a sharp increase in the cost of the BNB token. Initially, Yi He participated in the project as an investor / adviser.

Information about the other members of the team: developers, support workers, etc., is missing. But taking into account the active development of the platform, the other team members have professional qualities that contribute to the development of the project.

Investors / advisers

Also, in official sources, a list of investors and advisers is provided without an exact distribution of roles, it is also mentioned that some persons have decided to remain unknown. Among them are:

- Roger Ver is an early bitcoin investor, CEO of bitcoin.com, one of the most famous people in the crypto industry.

- Matthew Roszak is co-founder of Bloq, a partner of Tally Capital Founding.

- Ron Cao is Managing Director of Sky9 Capital.

- Yang Linke is a co-founder of BTCChina. Founder of ICOCoin.

- Da Hongfei is the founder of AntShares, CEO of Onchain.

- Jun Du is co-founder of Huobi.

- William Liu is a senior partner of AllBright Law Offices, the largest law firm in Shanghai.

- Xiaoning Nan is the founder of BitOcean.

Also at the time of the launch, Binance has enlisted the support of such companies as Morgan Stanley, SBI group, Accenture, Nomura, Blackhole Capital and Funcity Capital.

- "Analysis of the project team and affiliated persons" evaluation: 10 points out of 10. The outlook is positive.

The number of team - 2 points out of 2.

Team structure - 3 points out of 3.

Team competencies - 3 points out of 3.

Affiliated persons - 2 points out of 2.

The outlook is positive. Experienced team with an impressive successful background in the industry.

There are a large number of cryptocurrency exchanges, but there are no cases of creating a platform native token, which, moreover, has achieved such popularity.

- "Competitors” evaluation: 8 points out of 10. The outlook is positive.

Direct competitors - 4 points out of 4 (there are no similar examples of issuance by the exchange of the domestic currency, which provides additional opportunities and discounts).

Industry competitors - 4 points out of 4.

Project monitoring of competition - 0 points out of 2.

The outlook is positive. Despite the initial skepticism of the audience regarding the launch of its own token by the exchange and the possibility of rate manipulation, now the situation is highly positive. There are no similar examples, and Binance Coin is developing and finding new uses.

The Binance Exchange and its native BNB tokens are widely known around the world. The media regularly publishes articles about this exchange platform, positively assessing its activities. In addition to articles in major media, many users of cryptocurrency exchanges note Binance exchange in their blogs and reviews as the most convenient. Commission discounts when paid in BNB tokens are a strong motivating factor for their use.

In social networks of Binance there is a high activity and a large number of subscribers (on April 28, 2018):

- Twitter — 764 thousand subscribers;

- Medium — 4 thousand subscribers;

- Facebook — 65,7 thousand subscribers;

- Reddit — 41,7 thousand subscribers;

- Youtube — 2,800 subscribers;

- Telegram — 75,6 thousand subscribers.

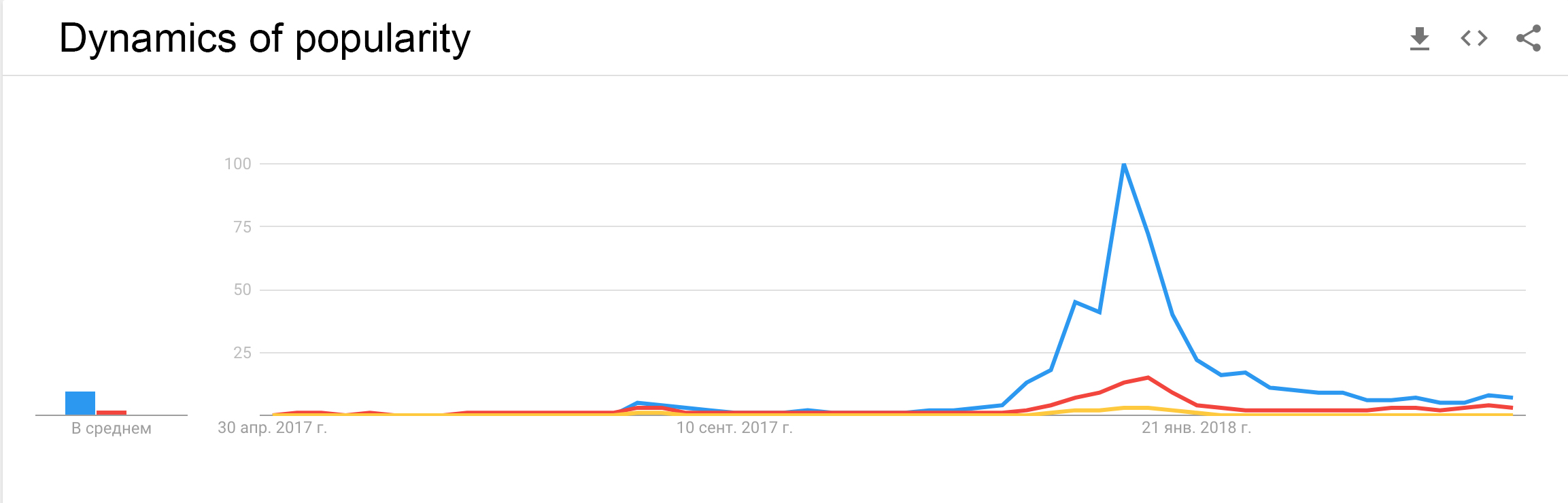

According to google.trends, the queries "binance", "binance coin", "binance coin bnb" refer to "super popular". The growth in popularity of requests falls on the period from the beginning of December 2017 to early February 2018, which corresponds to a period of rapid growth in the token cost and the reach of maximum cost (January 12):

The Binance exchange is the top in terms of the number of users, just 9 months after the launch, more than 6 million users got registered on it.

According to Etherscan on April 28, 2018 there are 297'083 addresses-owners of BNB tokens, and 391'631 transactions have been executed. It should be taken into account that the main activity associated with the BNB tokens refers directly to the Binance exchange, which uses its addresses for storage. As the Binance Exchange arrangement in terms of storing BNB tokens is unknown, the real number of "BNB users" is larger, but their tokens are stored on the exchange.

As it was repeatedly said, the main project for the BNB token is the Binance exchange.

However, on April 2, 2018, a partnership between the Qlink project and Binance was announced. Qlink is the first decentralized mobile network. The BNB tokens will be integrated into the decentralized application (Dapp) of the project.

This is the only partnership of this kind at the moment, but it is likely that new opportunities will emerge. In addition, in the case of the launch of the Binance Chain, which is not yet known, the functionality of the BNB tokens can be extended.

The Binance project and its ICO received active support from the famous representatives of the crypto industry, as was mentioned above. In addition, CEO Changpeng Zhao was engaged in such well-known projects as the OKCoin exchange, Blockchain.info. The status of team members and early investors is more than respectable.

- "Fame of the project" evaluation: 9 points out of 10. The outlook is positive.

Citation, social networks - 3 points out of 3.

Usability / distribution - 3 point out of 3.

Projects based on technology - 1 point out of 2 (for now a small number of third-party projects integrate the BNB token, but this was not its main function).

Famous persons in the team - 2 points out of 2.

The outlook is positive. The wide popularity of the project and the "recognition" of users, won in a short time.

Rating. "The Binance Coin (BNB)" evaluation: 53 points out of 70 — 75,71%. The outlook is positive.

The outlook is positive. The Binance Exchange and its Binance Coin tokens in a short time reached very high popularity rates. The team fulfills obligations and extends the use of the token.

Binance Exchange and its native BNB tokens are unique case of such a large-scale development of the project in a short time. The team contributes to the development of BNB tokens to stimulate customers’ loyalty. Considering that Binance is the most popular crypto exchange in the world, it can be expected that the BNB tokens will actively spread.

Introduction of additional opportunities for the token: the transfer of "crypto dust" into BNB, the holding of ICO on the exchange, using BNB, confirms the company's intentions to develop the project.

In March, it was announced the development of its own blockchain — Binance Chain, for which the BNB tokens will become native. The expansion of the Binance ecosystem and the development of the project form a positive outlook for Binance Coin.

Thus, by the present moment Binance and Binance Coin are an example of the competent work of the project team and leave a mainly positive impression. However, it is worthwhile to observe the further development and correlation between quarterly burning of tokens, the unlocking of team tokens, a reduction in the discount for using BNB to pay commissions, especially considering that the team owns 50% of the issued tokens.

References

Official website: https://www.binance.com

Medium: https://medium.com/@binance

Reddit: https://www.reddit.com/r/binance/

Facebook:https://www.facebook.com/binanceexchange/

Youtube: https://www.youtube.com/channel/UCfYw6dhiwGBJQY_-Jcs8ozw

Telegram: https://t.me/binanceexchange