Libra is a cryptocurrency launched by a group of corporations, the leading position in which at this point is occupied by Facebook. Libra will operate on the basis of its own Libra Network and will be managed by the Association consisting of large organizations, such as MasterCard, PayPal, ebay, etc.

The goal of Libra is to become a global cryptocurrency that will be used by people everywhere. Unlike many cryptocurrencies, Libra is backed by a currency basket, which should help to reduce its price volatility. It is planned that the launch of the project will take place in the first half of 2020.

At the first stage, the project will be launched as a permissioned network, but in the future the Libra Network intends to become a public network. However, despite the expected public nature of the network in the future, at the current stage, the Association will manage and supervise the network, launching validating nodes, determining development vectors, etc.

Libra is the first project of its kind for creating cryptocurrency for mass use, launched by such large companies. The number of Facebook users for whom Libra will be integrated into familiar social network interfaces exceeds 2 billion, which forms an impressive user base. However, despite the perspective of adapting a new cryptocurrency, crypto community ambiguously perceives the project due to the presence of centralization aspects that do not allow to perceive Libra as a truly independent decentralized cryptocurrency. And many regulators, in turn, speak out negatively due to concerns about the launch of such a major independent financial project that may affect the traditional banking system.

It is planned that two tokens will operate in the project: Libra and Libra Investment Token.

Libra

Libra is the main token, the cryptocurrency, which will operate as a payment instrument. Libra will be backed by a set of reserve currencies (the Libra Reserve), which should help to reduce its price volatility. Unlike most stablecoins, the cost of which is strictly pegged to a specific fiat currency unit or, for example, a precious metal, Libra will be backed by a basket of several currencies.

At the first launch stage in 2020 a reserve of four currencies will be formed: USD, GBP, EUR, JPY. The information on these plans is available on internet. In the official documentation such information is not yet available.

It is planned that users will not interact directly with the reserve. Special authorized resellers will be integrated with exchanges and other organizations involved in the purchase and sale of cryptocurrencies. They will carry out major operations in fiat currencies and Libra coins with the reserve, providing liquidity for end users.

The emission of new coins will be carried out with an increase in demand for Libra, and burning – with a decrease in demand. Herein the Association will not control monetary policy directly, emission or burning can be performed only if there are requests from authorized resellers. At the same time, any emission of new Libra coins should be carried out only if there is a fiat deposit.

At this stage there is no information in the public access on how exactly the authorized users will be selected, how demand will be controlled and the emission or burning of Libra will be initiated, how the presence of deposits in reserve will be confirmed, etc.

Additionally, such functions as multi-signatures for confirming the emission of new Libra coins can be configured.

Funds to Libra reserve will come from two sources: from investors by contributing into a special LIT token and from end users of Libra. The reserve will be stored in a distributed network of storages with a high reliability rating. Key factors in storage selection will be high security, auditability, and transparency. The reserve will be formed from a set of assets with low volatility: bank deposits, government securities, etc.

Libra Investment Token

The second token is the Libra Investment Token (LIT). At the moment there is little information about it. It is known that members of the Libra Association will acquire tokens in exchange for investments in the Libra ecosystem. To become a member of the Association, a company must invest at least $10 million through the purchase of the Libra Investment Token.

It is planned that the funds received from the sale of the Libra Investment Token can be invested in low-risk and low-income assets, and in case of the reserve groth and, accordingly, profitability, – to pay dividends to the Association members.

LIT tokens can also be used to distribute votes within a project management system.

At the current stage, there is no information in the public access about the amount of LIT that will be distributed among investors, whether there will be any restrictions on their use (for example, conservation them on the account for a certain period of time), etc.

Libra works on the basis of PoA (Proof of Authority) consensus mechanism with the LibraBFT algorithm. The LibraBFT is an algorithm based on the HotStuff algorithm, which in turn is based on the classical Practical Byzantine Fault Tolerance algorithm. Proof of Authority is an algorithm where the well-known trusted participants of the system take part in the consensus algorithm.

At the first stage, Libra will be launched as a permissioned blockchain, and the validator nodes will be the members of the Libra Association, including such companies as Uber, Visa, MasterCard, PayPal, and others. In order to become a member of the Association and a validator, you need to follow strict rules that include technical and business requirements. For example, not crypto industry companies should have a market capitalization of more than $1 billion or a client balance of more than $500 million. Given the high requirements that can be found at the link, it is assumed that qualified users with a good reputation will become the nodes and will ensure the proper operation of validator nodes.

The LibraBFT algorithm is resistant to Byzantine failures (failures in which the node continues to work in the network, but does not work correctly) under the assumption that there are only 3f+1 nodes operating in the network and no more than f of them work incorrectly (they can unintentionally or intentionally violate the rules of the protocol).

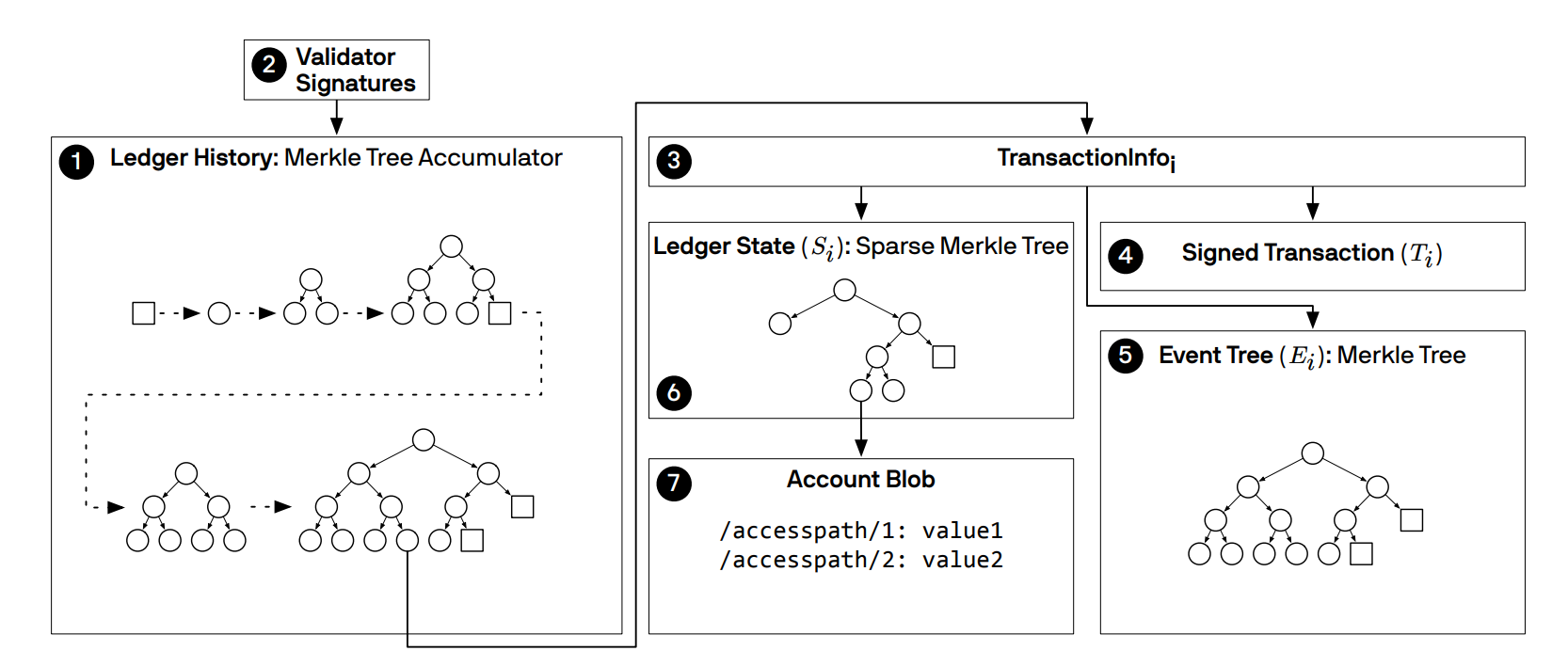

Validators receive transactions from clients and exchange them through a single mempool. The algorithm works during several sequential rounds. Wherein, at each round one of the nodes is the leader – the node that offers the block and collecting votes of the other validators. The validators receive a block from the leader, check for compliance with the voting rules and send the signed votes to the validator together with calculated by them the ledger identifiers, received after the block production. The leader collects votes to form a quorum certificate with ≥ 2f + 1 votes for this block, and distributes the certificate among all validators.

A block in round k is considered fixed when it has a quorum certificate and is confirmed by two more blocks with quorum certificates in rounds k + 1 and k + 2. More details on the specifics of consensus algorithm implementation can be found on the link in the project documentation..

In the future, Libra plans to switch to a public blockchain with PoS (Proof of Stake) consensus mechanism, in which the weight of the validators' votes will be proportional to the number of Libra coins they hold. However, at the current stage, the concept of transition to a public blockchain is in the finalization stage in order to minimize potential risks. Details and terms of the planned implementation are not available in public access.

The Libra protocol is written on Move language, which was specially developed for Libra, and works on the basis of the account model.

The Libra protocol is based on two concepts: ledger state and transaction. Ledger state is an actual snapshot of the Libra network data. Transaction is the only way to change the state of the ledger.

It is noteworthy that the traditional concept of a block is missing in Libra – the network ledger stores the sequence of completed transactions and events associated with them. When the consensus algorithm is performed, transactions are gathered into blocks to optimize the process, but the Libra data model assumes that the sequence of transactions does not depend on the block in which it was validated. Thus, the main data structure in Libra are transactions, not blocks. Therefore, Libra cannot be called a blockchain to the full.

The main types of participants that interact within the Libra blockchain: clients and validators. Clients create transactions and send them to the validator node for confirmation. The validator nodes launch a consensus protocol and make transactions, save transactions and the result of their execution in the blockchain. At the first stage of the system functioning, the validator nodes will be launched by the Association members.

The Move virtual machine (VM) is responsible for checking and execution transaction scripts written in Move bytecodes.

The Merkle Tree structure is used in the Libra Network for efficient data authentication. In most blockchains, for example, in Bitcoin, the Merkle Tree is built in each block separately on the base of the transactions it contains. In the Libra, the blockchain is perceived as a whole, and the Merkle Tree is calculated on the basis of all blockchain transactions. It is assumed that this should help to simplify the reference of third-party applications to the blockchain when reading or checking data.

The Libra network validators store a full copy of the blockchain and clients can send them a request to read data. However, any client can create his own replica by synchronizing with validators. This allows the client to independently verify the correctness of all transactions on the network. However, other clients can request data from the client, which stores the replica, and not just from validators. This allows to optimize the processing of read requests, since it is possible to create an unlimited number of replicas, while the number of validators in Libra is limited.

Libra supports trimming of stored data and deleting old versions of the ledger to reduce the space required for storage.

In the future, Libra plans to move to a public blockchain, but at the current stage the principles of functioning of the public network are at the stage of formation.

The project is managed by the Libra Association – a non-profit organization registered in Switzerland.

Due to the lack of common standards of cryptocurrency regulations in the world, and even the lack of a regulatory base in many jurisdictions, the launch of cryptocurrency under the Association of the most recognizable companies in the world has caused a great resonance among regulators in different countries. The US Senate Committee has already scheduled a hearing on the topic of Libra cryptocurrency. Particular attention will be paid to the protection of users’ information. Representatives of regulators from different countries have repeatedly expressed concerns. For example, BIS (Bank for International Settlements) stated that Libra can cause damage to the banking system. And the US Congressmen called to suspend the work on the project.

Although the the Libra network itself does not require KYC from users, some wallets may require users to go through this procedure. Including Calibra wallet, which is developed by a subsidiary of Facebook specifically for Libra cryptocurrency, will require KYC procedure. Calibra is registered in the USA in U.S. Financial Crimes Enforcement Network (FinCEN) as a money services business (MSB).

The head of the blockchain division of Facebook, David Marcus, has posted on Twitter that Calibra wallet will pay special attention to the privacy of users’ data and the separation of social and financial components. At the same time, he has also noted that data on Libra’s users can be transferred to the authorities to meet the requirements of regulators.

It is also worth noting that the sale of LIT tokens will have to be carried out in the STO format, since LIT tokens imply the income generation from investments and they are securities. But the details of the legal support of this process are not yet publicly available.

- "Architecture and Logic" evaluation: 6 points out of 10. The outlook is neutral.

Mechanisms and principles of emission — 2 points out of 3 (currently there are no details regarding the principles of operation of LIT tokens).

Blockchain (architecture and consensus building mechanism) — 2 points out of 4 (presence of centralization aspects, the principles of transition to a public blockchain are unclear).

Licensing and legal aspects — 2 points out of 3 (despite the project’s aspiration to meet the requirements of regulators, the scale of the project may negatively affect Libra’s perception by financial regulatory structures).

The outlook is neutral. On the one hand, Libra’s architecture is based on the classical proven approach, on the other hand, it offers a number of innovations, which among other things will simplify the interaction of third-party applications with Libra. However, at the first stage Libra will work on the basis of a permissioned corporate blockchain. It is worth watching the publication of information related to the transition to the public network.

At the current stage, the Libra network operates in a prototype test mode and there are no specific figures on the network's working performance. The project documentation states that after the launch, it is expected to reach TPS 1000 and 10 second of confirmation time. It is assumed that many transactions will be carried out offchain with the use of payment channels – and thus the above performance values will suffice to ensure the operation of the network at the first stages. It is also worth mentioning that, at least at the first stage of the work of Libra, the members of the Association will be the validator nodes, who will have to provide high technical requirements for the launch of nodes for processing transactions.

The main goal of Libra is the formation of a global convenient payment system. The Libra cryptocurrency is the means of payments in the project, which will be fully backed by a reserve from a basket of low-risk currencies. Most cryptocurrencies have high volatility and are used as an instrument for speculation, and not as a means of payment. Stabilizing the cost of Libra by backing should facilitate its acceptance by users. Thus, the main function of Libra is the performance of payment transactions.

As well as Bitcoin, Libra is a pseudo-anonymous network in which the user does not have to verify his account and can have any number of cryptographic addresses that are not connected to each other.

The project documentation mentions the prospect of using offchain payment channels to reduce the load on the network, but the details of the planned implementation are not currently available.

Libra will support smart contracts, that will be written on Move programming language. It is assumed that at the first stage of the network operation, only pre-built smart contracts can be executed, which creates certain restrictions on network usage. The availability of ready contracts is convenient for users in case they cover the main demanded usage scenarios. However, currently there is no information about the available types of contracts. On the other hand, such an approach will be able to minimize the number of potential errors in contract codes, which theoretically could lead to the loss of funds and, thereafter, to deterioration of the project’s reputation.

It is planned that Libra will be managed with the use of votings, which, among other things, can be performed in onchain mode.

As of June 26, 2019, Libra has launched a test network, through which developers can familiarize themselves with the project, learn the new language Move, try to write their own smart contracts, etc. The platform code is available on github. The detailed documentation on working with the platform and with Move language is available for developers.

It is planned that the launch of the main network will take place in the first half of 2020.

Calibra will become a native wallet for Libra. Calibra is a subsidiary of Facebook, Inc. and operates independently of Facebook. Calibra wallet will be available as a separate application for Android and iOS, and will also be integrated into Facebook and WhatsApp messengers. It is planned that, at the first stage, the wallet will be primarily focused on p2p payments and will maintain the minimal functionality: QR codes, etc. In the future, integration with Point of Sale devices, etc. is planned to expand integration with the business. Calibra will require KYC procedures from users.

On the github of the project, you can find out more about the available APIs.

The main network of the project has not been launched yet and it is not yet known what special tools will be made for integration with other crypto projects.

2."Functionality and software platform" evaluation: 7 points out of 10. The outlook is neutral.

Performance and scalability — 1 point out of 2 (there are no performance figures yet. With the closed nature of the network, there is high probability of providing high bandwidth, but it is not clear whether the project will be able to provide similar performance after switching to a public network).

Built-in mechanisms and functions — 3 points out of 3.

Product — 2 points out of 4 (the test network has been launched).

Integration options — 1 point out of 1.

The outlook is neutral. Libra should provide basic payment functionality for its potential users. It is worth observing how exactly users’ applications will be implemented and whether the network will be able to withstand the load if a large audience is connected. It is also worth watching for the emergence of alternative wallets that will not require KYC from users, and trends in their use.

On the official website of Libra, you can read the detailed documentation describing the basic principles of functioning of Libra:

- White Paper overview, describing the overall concept of the project.

- Technical White Paper.

- Technical documentation for developers..

- A document on the new programming language Move, created specifically for Libra.

- A document, describing LibraBFT consensus algorithm.

- Sections on the site, dedicated to the Libra Association, the Libra reserve.

Documentation allows to create a comprehensive view of the project, including the details of technical operation of the platform.

Road Map is not available in the public access. It is known only that the launch of the main network will take place in the first half of 2020.

- "Analysis of Road Map and White Paper" evaluation: 5 points out of 10. The outlook is neutral.

White Paper — 5 points out of 5.

Road Map — 0 points out of 5 (absent).

The outlook is neutral. The high quality of project documentation is leveled by the absence of the Roadmap.

The Libra blockchain and the reserve are managed by the Libra Association. The Libra Association is managed by the the Libra Association Council, which consists of representatives from each member of the Association. Members of the Association are large businesses, social and scientific organizations. The rules for joining the Association can be found on the official website.

Project management decisions will be made by voting, and the voting threshold may differ depending on the importance of the decision. Regardless of how many Libra or LIT tokens the member of the Association owns, his vote can be represented by the largest of: 1 vote or 1% of the total number of votes. Members of the Association whose voting weight is above the limit, can delegate their votes to the Libra Association Board for their redistribution, for example, to scientific or social organizations that cannot make investments of at least $10 million (threshold for entering the Association, more details on the link).

The document on the Libra Association describes the following roles, without indicating specific individuals:

- Managing Director. The MD is elected by the council every three years and manages the main project executive team responsible for the daily operation of the Libra Network.

- Deputy MD/COO, serving as the MD's replacement in absence; HR and administrative team.

- Chief Financial Officer — treasury and currency-exchange team, investor relations team.

- Head of Product — software and the Libra network management team; developer community management team.

- Head of Business Development — BD team, Founding Members relations team.

- Head Economist — economics team.

- Head of Policy — advocacy and communications teams.

- Head of Compliance and Financial Intelligence.

- General Counsel — legal team.

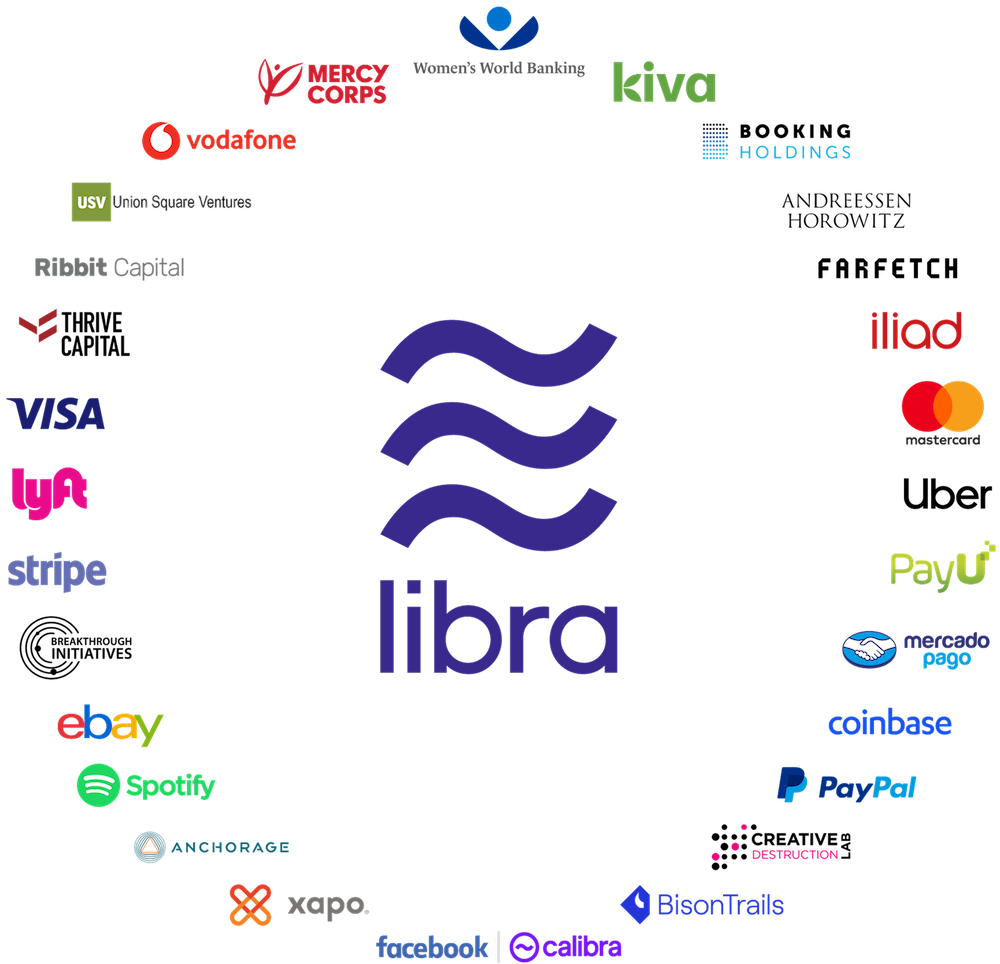

The initial group of organizations that will become members of the Association and will work on the final version of the Association's charter by industry:

- Payment systems: Mastercard, PayPal, PayU (Naspers’ fintech arm), Stripe, Visa.

- Technology companies and marketplaces: Booking Holdings, eBay, Facebook/Calibra, Farfetch, Lyft, MercadoPago, Spotify AB, Uber Technologies, Inc.

- Telecommunications: Iliad, Vodafone Group.

- Blockchain companies: Anchorage, Bison Trails, Coinbase, Inc., Xapo Holdings Limited.

- Venture Capital: Andreessen Horowitz, Breakthrough Initiatives, Ribbit Capital, Thrive Capital, Union Square Ventures.

- Non-profit organizations and academic institutions: Creative Destruction Lab, Kiva, Mercy Corps, Women’s World Banking.

It is planned that by the time of the initial launch in the first half of 2020, the Association will include about 100 participants.

Initially, Facebook played a key role in the development of the project. It is assumed that until the end of 2019, Facebook will keep the leading role in the project, but after the launch of the Libra network, its rights and powers will be exactly the same as those of other members of the Association.

- "Analysis of the project team and affiliated persons" evaluation: 8 points out of 10. The outlook is positive.

The number of the team – 2 points out of 2.

Team structure – 2 points out of 3 (there is no information on the full structure of the team).

Team competencies – 2 points out of 3 (there is no information on the full structure of the team).

Affiliated persons – 2 points out of 2.

The outlook is positive. Despite the lack of full information on the structure of the team members, there is no doubt that the project will be supported by highly qualified specialized experts.

The goal of Libra is to form a global payment system using blockchain technology. Many crypto projects have similar goals and can theoretically be considered as competitors.

Bitcoin is the most well-known payment cryptocurrency, but its key difference is the open nature of the network. the Libra network is permissioned: only a special circle of members can be the validator on the network. It is planned that in the future the project will move to a public blockchain. Thus, at the current stage, Libra significantly stands out by these and, to some extent, it is more correctly to compare it with more usual payment systems – for example, with PayPal, and not with Bitcoin.

Such projects as Dash, Nano and many others seek to improve the capabilities of cryptocurrency by adding convenient tools to their wallets. In addition, for example, a decentralized project management system is being developed in Dash, which allows, on the one hand, to make decisions efficiently, and on the other, to maintain a decentralized anonymous working principle.

Another difference of Libra is the presence of the reserve that provides cryptocurrency, which should help to stabilize its value and to make it a more convenient payment tool, unlike most other cryptocurrencies with high volatility. From this point of view, Libra has more in common with stablecoins, the value of which is pegged to some stable asset, such as dollar or gold. Among such projects we can mention Tether, Digix, TrueUSD and others.

Another project to create a backed cryptocurrency by a large company is JPM Coin, launched by the American bank – JPMorgan Chase. The cost of JPM Coin is pegged to the US dollar, the coin will be used for transfers between large institutional clients, and not for end-user interaction.

First of all, the Libra project stands out by the largest number of potential users – Facebook social network clients (over 2.4 billion), who will receive embedded wallets in their messengers.

- "Competitors" evaluation: 5 points out of 10. The outlook is positive.

Direct competitors – 3 points out of 4 (there is competition).

Industry competitors – 2 points out of 4 (high competition).

Project monitoring of competition – 0 point out of 2 (absent).

The outlook is positive. Despite the presence of competition in the industry, Libra has chances to become one of the most used cryptocurrency means of payment.

Citation, social networks

The Libra project is one of the most talked about crypto projects in the community. Despite the fact that the release of documentation and the test network took place quite recently – in the middle of June 2019 – almost all media published their reviews on the project. Every day a greater amount of news appear, related to Libra. Libra is the first example of launching a corporate cryptocurrency for mass use by such large companies, which in a logical way attracted the maximum attention of not only the crypto community, but also of the world as a whole.

The popularity of social accounts on June 27, 2019:

- Twitter — 22.4 thousand subscribers.

- Facebook — 9.6 thousand subscribers.

- Instagram — 6.4 thousand subscribers.

A small audience in the social accounts of the project is due to the fact that the official announcement of Libra took place less than 2 weeks ago.

Applicability

On June 27, 2019, the Libra network operates in the test mode, therefore, there is no real activity and use of cryptocurrency.

Projects working with Libra

The Libra project was launched by Facebook social network with the participation of a great number of large companies. The native wallet Calibra will be integrated with Facebook, WhatsApp messengers and Instagram. Thus, a multi-billion audience of these projects will receive an access to cryptocurrency after its launch in 2020.

The Libra Association includes a great number of large companies (for more details, see “Analysis of the project team and affiliated persons” section) from different industries, and their number will increase. Currently, it is not known how they will use Libra cryptocurrency in their services. It also became known that some members joined the Association on the condition that they would not promote the project and use cryptocurrency directly in their services, as regulators in many countries expressed a negative opinion regarding Libra.

Information about the integration of Libra with other independent projects is not yet available.

Famous persons in the team

Despite the lack of indication of specific individuals in the project team, the Libra Association includes the most recognizable international companies.

- "Fame of the project" evaluation: 6 points out of 10. The outlook is positive.

Citation, social networks – 3 points out of 3.

Usability / distribution – 0 points out of 2 (the main network has not been launched yet).

Projects based on technology – 1 point out of 3 (despite the lack of details on the integration of Libra cryptocurrency with members of the Association, it is likely that some of them will use Libra).

Famous persons in the team – 2 points out of 2.

The outlook is positive. “Facebook cryptocurrency” will undoubtedly be a widely discussed project and will increase its popularity. It is especially important to monitor how its real audience will grow after launch and the number of services integrating Libra.

The launch of Libra has caused a strong and ambiguous reaction in the community. On the one hand, launching a cryptocurrency of this magnitude can significantly increase the audience of cryptocurrency users and affect the financial services sector, making cryptocurrency payments much more accessible for users around the world. On the other hand, at the first stage Libra will work on the basis of a permissioned blockchain, which will be managed by a narrow circle of companies, which does not comply with decentralization principles and transparency accepted in the crypto community. Libra may turn out to be an unstable to censorship project.

However, the project documentation states the intention to make the Libra network public in the future. But at the moment there is neither a complete concept of the network operation in public mode, nor the time stamps of the planned transition.

Another concern of users is the ambiguous reputation of Facebook social network, which at the current stage is playing a leading role in the development of Libra. Facebook has come across several large-scale user data leaks and it’s unclear if the story will happen again. Also, Facebook is often accused of collecting users’ data and using it for its own purposes, the prospect of disclosure and/or monetization of data on users' financial transactions is perceived negatively.

Calibra wallet will work not only as an independent application, but also as a component of Facebook Messenger and WhatsApp and will require KYC procedures. A large amount of personal data is stored in the social accounts of Facebook users; therefore, it is not clear whether the proper protection of the confidentiality of financial data can be ensured in the case of a direct link between the wallet and the social account. The centralized storage of social and identification data of users in combination with the history of their payments causes many concerns. The crypto community, which seeks decentralization and equality of participants, is skeptical about the emergence of a “monopolist” in the name of Libra.

Another potential risk of the project is the attitude of the regulators. Despite the desire of the project to meet the requirements of regulators, it is unclear how the world will perceive a cryptocurrency with such influence, especially given the fact that this area is still relatively young and the legal field in different jurisdictions is different, and in many has not even been formed. Many governments are wary of the launch of Libra: US congressmen called on Facebook to suspend the work on Libra, Chairman of the State Duma Committee on the Financial Market Anatoly Aksakov has stated that in Russia Libra would not be legalized, etc.

Despite the presence of a large number of fears, many experts positively perceive the launch of Libra, because it can give a strong push to the development of the industry and give access to cryptocurrencies to a huge audience.

- "Trust index" evaluation: 7 points out of 10. Scam probability: below average.

Scam probabiliry is below average. Despite a large number of fears in the community, Libra should be perceived, at least at the current stage, not as a replacement for Bitcoin and a fully independent decentralized project, but as a predominantly corporate solution, which, despite certain shortcomings, can be a step towards mass acceptance of cryptocurrency as a form of payment and the blockchain as a valuable technology. However, one of the main risks at this stage is the negative attitude towards the project in regulatory authorities.

RATING. “Libra” evaluation: 44 points out of 70 – 62.86%. The outlook is neutral.

The outlook is neutral. Libra can not be called cryptocurrency in the full sense of the word because of its corporate nature. However, the project has a number of advantages, including the well-known and authoritative representatives of the Association, as well as the enormous size of the potential audience that can revolutionize the financial sector. It’s definitely worth monitoring the launch of the main network, the acceptance of the project by both users and regulatory structures, as well as the fulfillment of the project promises to switch to a public blockchain. Libra should not be perceived as, for example, a Bitcoin competitor, since at the current stage this project is more like something between classical payment systems and open cryptocurrencies.

Libra is a “corporate” cryptocurrency, backed by a basket of stable currencies launched by large corporations with the main participation of Facebook social network. The project aims to create a global and accessible worldwide payment system. At the same time, instruments for working with Libra cryptocurrency will be integrated into the most popular social applications. Libra can be a compromise between fully decentralized cryptocurrencies and current banking payment systems.

The advantages of the project include:

- The authority and competence of the companies at the head of the project.

- Availability of the test network and instruments for developers.

- High-quality project documentation.

- Availability of collateral in Libra cryptocurrency, which helps to reduce volatility.

- Large coverage of potential user audience.

The disadvantages include:

- The operation on the basis of a permissioned blockchain.

- The lack of details of the planned transition to an public network, including the principles of PoS algorithm and validator fees.

- Centralized approach.

- Negative attitude of regulators in many countries.

- The mandatory KYC in the own wallet can be perceived negatively by some users.

- Absence of the Road Map with a detailed development plan.

References

Official website: https://libra.org

Technical documentation: https://developers.libra.org

Github: https://github.com/libra

Twitter: https://twitter.com/libra_

Facebook: https://www.facebook.com/LibraAssociation/

Instagram: https://www.instagram.com/libra/