Chainlink — децентрализованная сеть оракулов, которая подключается к данным и приложениям из реального мира. С помощью оракулов в блокчейн можно загружать данные, позволяя смарт-контрактам взаимодействовать с внешней средой.

Оракулы необходимы для создания и работы децентрализованных приложений и смарт-контрактов, которые опираются на какие-либо внешние данные. Chainlink занимается созданием среды надежных оракулов, данные которых могут использоваться разными блокчейнами, обеспечивая связь между цифровым и реальным миром. Причем смарт-контрактам необходима связь и для формирования входов, которые влияют на работу смарт-контрактов и могут быть триггерами для изменения его состояния, и для выходов — чтобы результат работы смарт-контракта вызывал действия во внешнем мире, например, передачу прав на собственность.

Chainlink занимается разработкой децентрализованной сети оракулов, которая является более надежной в сравнении с централизованными сервисами, предоставляющими схожие услуги.

Токен проекта — LINK.

Общее количество токенов — 1’000’000’000.

LINK выпущен на базе блокчейна Ethereum и является токеном стандарта ERC-677.

Токены LINK используются для оплаты работы операторов нод по предоставлению данных из внешних источников. Если контракт в сети решит подключиться к ноде Chainlink, ему будет нужно оплатить услуги в токенах LINK. Стоимость устанавливается оператором с учетом текущего спроса на внешние ресурсы.

ICO проекта состоялось в сентябре 2017 года, было собрано $32 млн.

Распределение токенов:

- 35% — продажа в ходе ICO.

- 35% — для поощрения операторов узлов.

- 30% — проекту на дальнейшую разработку протокола.

Публичная фаза ICO завершилась за несколько минут, при этом возник скандал, связанный с необычной процедурой проведения ICO и предположениями в нечестности со стороны команды. Подробнее в разделе “Индекс доверия”.

На 8 июля 2019 в публичном доступе отсутствует детали планируемой программы поощрения операторов узлов: механизмы, планируемые темпы распространения токенов и др. неизвестны.

Chainlink работает на базе блокчейна Ethereum, который использует алгоритм консенсуса Proof-of-Work: для добавления нового блока майнеры должны решить сложную вычислительную задачу.

В скором времени в Ethereum планируется обновление сети и переключение на гибридный механизм Proof-of-Work / Proof-of-Stake после внедрения протокола Casper. Подробнее в анализе блокчейн-платформы Ethereum.

Chainlink построен на базе блокчейна Ethereum. Команда планирует, что в будущем их решение будет поддерживать все основные платформы для смарт-контрактов как для оффчейн, так и для кросс-чейн взаимодействий.

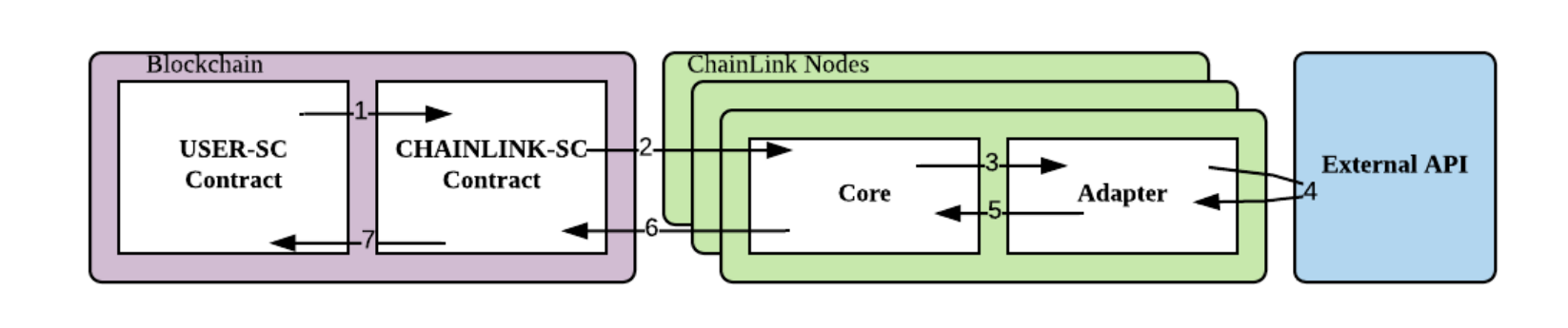

Архитектура Chainlink состоит из ончейн и оффчейн элементов.

Основные ончейн элементы:

- CHAINLINK-SC — контракт в блокчейне, который является ончейн интерфейсом по обработке запросов от пользовательских контрактов (USER-SC). CHAINLINK-SC состоит из трёх компонентов:

- Репутационный контракт (reputation contract) — отслеживает метрики производительности поставщиков оракул-сервисов.

- Контракт для согласования запросов (order-matching contract) — принимает Соглашение об уровне обслуживания (service level agreement, SLA), регистрирует его параметры, собирает предложения от поставщиков оракулов, выбирает предложения, используя репутационный контракт, и финализирует SLA.

- Агрегирующий контракт (aggregating contract) — собирает ответы от поставщиков оракулов, агрегирует их в единый ответ и собирает метрики поставщиков оракулов для последующей передачи в репутационный контракт.

Поток действий ончейн составляющей состоит из следующих этапов: выбор оракула, предоставление данных, агрегация результатов.

Оффчейн составляющая Chainlink на первом этапе состоит из группы нод, подключенных к сети Ethereum. Эти ноды независимо собирают ответы на запросы, после чего с помощью специального механизма они агрегируются в один глобальный ответ, который возвращается к пользовательскому контракту (USER-SC). Операторы нод могут устанавливать и разрабатывать специальное ПО для адаптеров, которое будет позволять интегрировать Chainlink с любыми оффчейн-сервисами.

Основные шаги работы Chainlink:

- Пользовательский контракт (USER-SC) делает запрос к ончейн контракту CHAINLINK-SC.

- CHAINLINK-SC записывает события запроса для оракулов.

- Ядро ChainLink принимает событие и передает назначение адаптеру.

- Адаптер обрабатывает ответ и передает его обратно в ядро.

- Ядро передает данные с ответами в CHAINLINK-SC.

- CHAINLINK-SC агрегирует ответы и передает единым ответом в USER-SC.

В юридических документах на официальном сайте указана компания SmartContract Chainlink Limited SEZC, зарегистрированная на Каймановых Островах.

В официальных чатах представители команды не комментируют вопросы, касающиеся юридических и регуляторных аспектов проекта. Во время публичной фазы ICO пользователи не должны были проходить процедуру KYC.

С учетом текущих доступных сведений об использовании токена LINK, маловероятно, что он может рассматриваться как security.

- Оценка «Архитектура и логика»: 6 баллов из 10. Прогноз нейтральный.

Механизм и принципы эмиссии — 1 балла из 3 (высокая централизация распределения токенов, отсутствие подробного описания токеномики).

Блокчейн (архитектура и механизм обеспечения консенсуса) — 4 балла из 4.

Лицензирование и юридические аспекты — 1 балл из 3 (отсутствует данные о взаимодействии проекта с регуляторами, команда не комментирует никаким образом юридические аспекты деятельности проекта).

Прогноз — нейтральный. Chainlink соединяет элементы ончейн и оффчейн архитектуры для обеспечения оптимальной работы сети оракулов. Стоит следить за обновлениями, связанными с токеномикой проекта.

At the current stage, the Libra network operates in a prototype test mode and there are no specific figures on the network's working performance. The project documentation states that after the launch, it is expected to reach TPS 1000 and 10 second of confirmation time. It is assumed that many transactions will be carried out offchain with the use of payment channels – and thus the above performance values will suffice to ensure the operation of the network at the first stages. It is also worth mentioning that, at least at the first stage of the work of Libra, the members of the Association will be the validator nodes, who will have to provide high technical requirements for the launch of nodes for processing transactions.

The main goal of Libra is the formation of a global convenient payment system. The Libra cryptocurrency is the means of payments in the project, which will be fully backed by a reserve from a basket of low-risk currencies. Most cryptocurrencies have high volatility and are used as an instrument for speculation, and not as a means of payment. Stabilizing the cost of Libra by backing should facilitate its acceptance by users. Thus, the main function of Libra is the performance of payment transactions.

As well as Bitcoin, Libra is a pseudo-anonymous network in which the user does not have to verify his account and can have any number of cryptographic addresses that are not connected to each other.

The project documentation mentions the prospect of using offchain payment channels to reduce the load on the network, but the details of the planned implementation are not currently available.

Libra will support smart contracts, that will be written on Move programming language. It is assumed that at the first stage of the network operation, only pre-built smart contracts can be executed, which creates certain restrictions on network usage. The availability of ready contracts is convenient for users in case they cover the main demanded usage scenarios. However, currently there is no information about the available types of contracts. On the other hand, such an approach will be able to minimize the number of potential errors in contract codes, which theoretically could lead to the loss of funds and, thereafter, to deterioration of the project’s reputation.

It is planned that Libra will be managed with the use of votings, which, among other things, can be performed in onchain mode.

As of June 26, 2019, Libra has launched a test network, through which developers can familiarize themselves with the project, learn the new language Move, try to write their own smart contracts, etc. The platform code is available on github. The detailed documentation on working with the platform and with Move language is available for developers.

It is planned that the launch of the main network will take place in the first half of 2020.

Calibra will become a native wallet for Libra. Calibra is a subsidiary of Facebook, Inc. and operates independently of Facebook. Calibra wallet will be available as a separate application for Android and iOS, and will also be integrated into Facebook and WhatsApp messengers. It is planned that, at the first stage, the wallet will be primarily focused on p2p payments and will maintain the minimal functionality: QR codes, etc. In the future, integration with Point of Sale devices, etc. is planned to expand integration with the business. Calibra will require KYC procedures from users.

On the github of the project, you can find out more about the available APIs.

The main network of the project has not been launched yet and it is not yet known what special tools will be made for integration with other crypto projects.

- Оценка «Функционал и программная платформа»: 8 баллов из 10. Прогноз позитивный.

Производительность и масштабируемость — 1 балл из 2 (невысокие показатели).

Встроенные механизмы и функции — 3 балла из 3.

Продукт — 3 балла из 4 (отсутствие собственных приложений).

Возможности интеграции — 1 балл из 1.

Прогноз — позитивный. Chainlink предлагает решение для владельцев приложений и смарт-контрактов, которое можно адаптировать под нужные задачи и источники данных. Chainlink использует ряд инструментов, которые должны повышать надежность оракулов и предоставляемых ими данных, так как это одна из наиболее важных задач оракул-сервиса. Стоит наблюдать за работой основной сети и способностью системы обеспечивать достоверность данных.

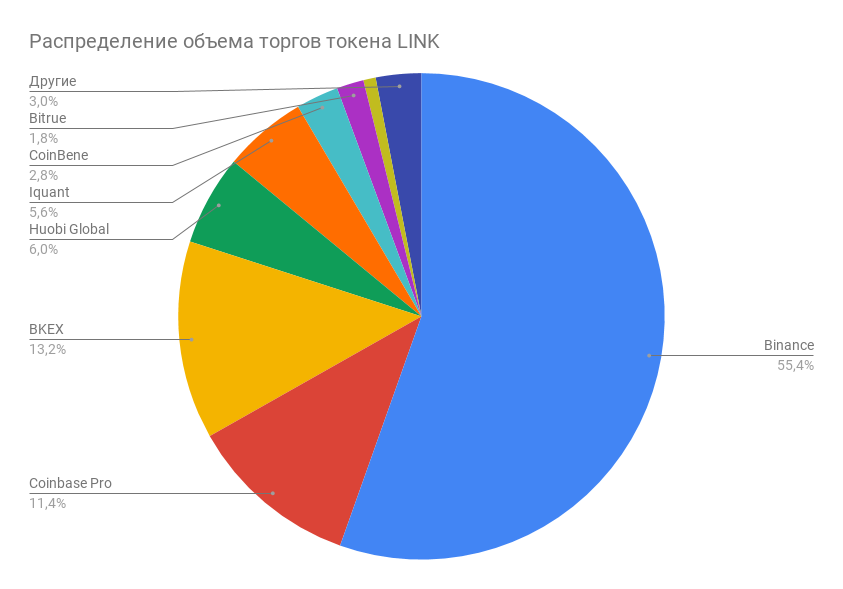

По данным coinmarketcap на 9 июля 2019 токен LINK представлен на 31 обменной площадке, при этом объем торгов распределен следующим образом:

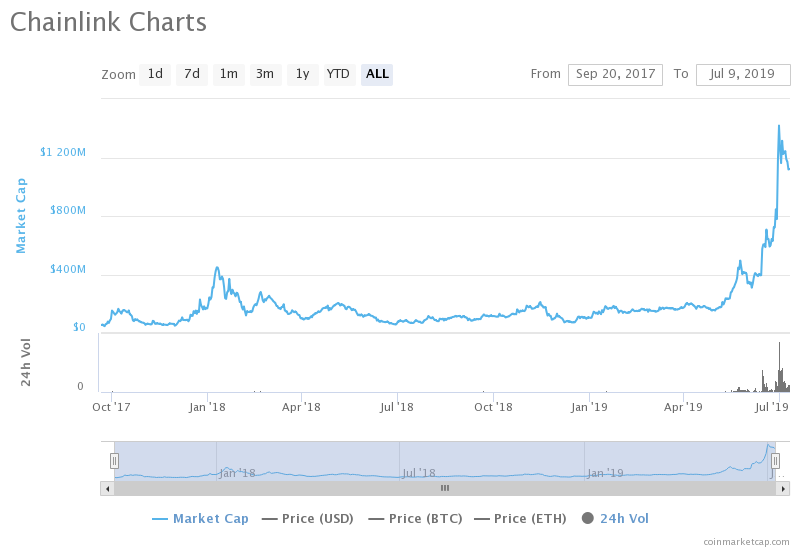

На 9 июля 2019 капитализация Chainlink составляет $1'113'267'703 / 90'428 BTC, что ставит проект на 17 место в общем ТОПе криптопроектов.

В конце апреля 2019 начался значительный прирост показателей: капитализация проекта выросла более чем в 7 раз. Резкий рост скорее всего вызван приближением запуска основной сети в сочетании с общими положительными трендами крипторынка. Предыдущий максимум капитализации был достигнут в январе 2018 в период общего роста крипторынка и составил около $450 млн, 29 июня 2019 был поставлен новый рекорд: капитализация составляла более $1,5 млрд. Также стоит отметить значительное увеличение объема торгов токенами LINK, на 9 июля 2019 суточный объем торгов составляет $134'725'392 / 10'943 BTC.

По данным coinmarketcap в обороте находятся 350’000’000 токенов LINK (35% от общего количества), с большой вероятностью это токены, которые были распространены в ходе ICO. Остальные токены находятся под управлением команды (токены выделенные на вознаграждение операторов и на развитие проекта), при этом достоверно неизвестно есть ли у токенов локап период и какой план выпуска их в оборот.

Динамика капитализации по данным coinmarketcap:

На 9 июля 2019 стоимость токена LINK составляет $3,18 / 0,00025836 BTC.

Первый пик значительного роста цены пришелся на зиму 2018 – 2019 года, период общего роста крипторынка. В начале января 2018 был достигнут локальный максимум, стоимость составила около $1,4, после чего начался даунтренд и период постепенной стабилизации. В конце декабря 2018 началась небольшая положительная динамика, а в конце апреля 2019 начался резкий рост, коррелирующий с приближением запуска основной сети и позитивными настроениями на крипторынке. За два месяца стоимость токена LINK увеличилась примерно в 10 раз, максимальное значение стоимости было достигнуто 29 июня 2019 — $4,51. После этого началось снижение и к 9 июля 2019 цена снизилась примерно на 30%.

Динамика стоимости токена LINK:

- Оценка «Статистика»: 7 баллов из 10. Прогноз нейтральный.

Распространение — 2 балл из 3 (более половины объема торгов приходится на одну площадку).

Динамика капитализации — 3 балла из 4 (высокая волатильность).

Динамика цены токенов — 2 балла из 3 (риски, связанные с падением стоимости в случае выпуска в оборот большого количества токенов).

Прогноз — нейтральный. В последние несколько месяцев наблюдается значительный резкий прирост статистических показателей. Стоит наблюдать за стабилизацией показателей и снижением волатильности, так как несмотря на положительный характер возрастающего тренда, присутствует риск не менее резкого падения.

On the official website of Libra, you can read the detailed documentation describing the basic principles of functioning of Libra:

- White Paper overview, describing the overall concept of the project.

- Technical White Paper.

- Technical documentation for developers..

- A document on the new programming language Move, created specifically for Libra.

- A document, describing LibraBFT consensus algorithm.

- Sections on the site, dedicated to the Libra Association, the Libra reserve.

Documentation allows to create a comprehensive view of the project, including the details of technical operation of the platform.

Road Map is not available in the public access. It is known only that the launch of the main network will take place in the first half of 2020.

- "Analysis of Road Map and White Paper" evaluation: 5 points out of 10. The outlook is neutral.

White Paper — 5 points out of 5.

Road Map — 0 points out of 5 (absent).

The outlook is neutral. The high quality of project documentation is leveled by the absence of the Roadmap.

The Libra blockchain and the reserve are managed by the Libra Association. The Libra Association is managed by the the Libra Association Council, which consists of representatives from each member of the Association. Members of the Association are large businesses, social and scientific organizations. The rules for joining the Association can be found on the official website.

Project management decisions will be made by voting, and the voting threshold may differ depending on the importance of the decision. Regardless of how many Libra or LIT tokens the member of the Association owns, his vote can be represented by the largest of: 1 vote or 1% of the total number of votes. Members of the Association whose voting weight is above the limit, can delegate their votes to the Libra Association Board for their redistribution, for example, to scientific or social organizations that cannot make investments of at least $10 million (threshold for entering the Association, more details on the link).

The document on the Libra Association describes the following roles, without indicating specific individuals:

- Managing Director. The MD is elected by the council every three years and manages the main project executive team responsible for the daily operation of the Libra Network.

- Deputy MD/COO, serving as the MD's replacement in absence; HR and administrative team.

- Chief Financial Officer — treasury and currency-exchange team, investor relations team.

- Head of Product — software and the Libra network management team; developer community management team.

- Head of Business Development — BD team, Founding Members relations team.

- Head Economist — economics team.

- Head of Policy — advocacy and communications teams.

- Head of Compliance and Financial Intelligence.

- General Counsel — legal team.

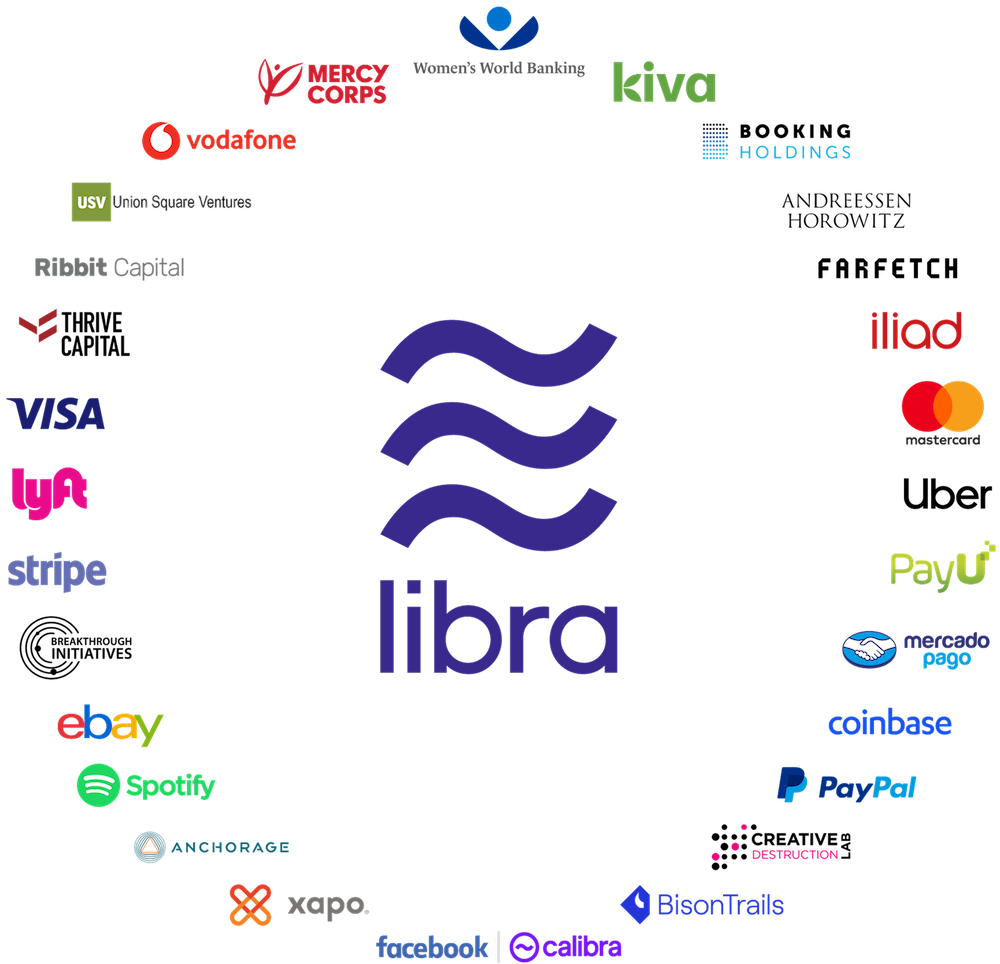

The initial group of organizations that will become members of the Association and will work on the final version of the Association's charter by industry:

- Payment systems: Mastercard, PayPal, PayU (Naspers’ fintech arm), Stripe, Visa.

- Technology companies and marketplaces: Booking Holdings, eBay, Facebook/Calibra, Farfetch, Lyft, MercadoPago, Spotify AB, Uber Technologies, Inc.

- Telecommunications: Iliad, Vodafone Group.

- Blockchain companies: Anchorage, Bison Trails, Coinbase, Inc., Xapo Holdings Limited.

- Venture Capital: Andreessen Horowitz, Breakthrough Initiatives, Ribbit Capital, Thrive Capital, Union Square Ventures.

- Non-profit organizations and academic institutions: Creative Destruction Lab, Kiva, Mercy Corps, Women’s World Banking.

It is planned that by the time of the initial launch in the first half of 2020, the Association will include about 100 participants.

Initially, Facebook played a key role in the development of the project. It is assumed that until the end of 2019, Facebook will keep the leading role in the project, but after the launch of the Libra network, its rights and powers will be exactly the same as those of other members of the Association.

- "Analysis of the project team and affiliated persons" evaluation: 8 points out of 10. The outlook is positive.

The number of the team – 2 points out of 2.

Team structure – 2 points out of 3 (there is no information on the full structure of the team).

Team competencies – 2 points out of 3 (there is no information on the full structure of the team).

Affiliated persons – 2 points out of 2.

The outlook is positive. Despite the lack of full information on the structure of the team members, there is no doubt that the project will be supported by highly qualified specialized experts.

The goal of Libra is to form a global payment system using blockchain technology. Many crypto projects have similar goals and can theoretically be considered as competitors.

Bitcoin is the most well-known payment cryptocurrency, but its key difference is the open nature of the network. the Libra network is permissioned: only a special circle of members can be the validator on the network. It is planned that in the future the project will move to a public blockchain. Thus, at the current stage, Libra significantly stands out by these and, to some extent, it is more correctly to compare it with more usual payment systems – for example, with PayPal, and not with Bitcoin.

Such projects as Dash, Nano and many others seek to improve the capabilities of cryptocurrency by adding convenient tools to their wallets. In addition, for example, a decentralized project management system is being developed in Dash, which allows, on the one hand, to make decisions efficiently, and on the other, to maintain a decentralized anonymous working principle.

Another difference of Libra is the presence of the reserve that provides cryptocurrency, which should help to stabilize its value and to make it a more convenient payment tool, unlike most other cryptocurrencies with high volatility. From this point of view, Libra has more in common with stablecoins, the value of which is pegged to some stable asset, such as dollar or gold. Among such projects we can mention Tether, Digix, TrueUSD and others.

Another project to create a backed cryptocurrency by a large company is JPM Coin, launched by the American bank – JPMorgan Chase. The cost of JPM Coin is pegged to the US dollar, the coin will be used for transfers between large institutional clients, and not for end-user interaction.

First of all, the Libra project stands out by the largest number of potential users – Facebook social network clients (over 2.4 billion), who will receive embedded wallets in their messengers.

- "Competitors" evaluation: 5 points out of 10. The outlook is positive.

Direct competitors – 3 points out of 4 (there is competition).

Industry competitors – 2 points out of 4 (high competition).

Project monitoring of competition – 0 point out of 2 (absent).

The outlook is positive. Despite the presence of competition in the industry, Libra has chances to become one of the most used cryptocurrency means of payment.

Citation, social networks

The Libra project is one of the most talked about crypto projects in the community. Despite the fact that the release of documentation and the test network took place quite recently – in the middle of June 2019 – almost all media published their reviews on the project. Every day a greater amount of news appear, related to Libra. Libra is the first example of launching a corporate cryptocurrency for mass use by such large companies, which in a logical way attracted the maximum attention of not only the crypto community, but also of the world as a whole.

The popularity of social accounts on June 27, 2019:

- Twitter — 22.4 thousand subscribers.

- Facebook — 9.6 thousand subscribers.

- Instagram — 6.4 thousand subscribers.

A small audience in the social accounts of the project is due to the fact that the official announcement of Libra took place less than 2 weeks ago.

Applicability

On June 27, 2019, the Libra network operates in the test mode, therefore, there is no real activity and use of cryptocurrency.

Projects working with Libra

The Libra project was launched by Facebook social network with the participation of a great number of large companies. The native wallet Calibra will be integrated with Facebook, WhatsApp messengers and Instagram. Thus, a multi-billion audience of these projects will receive an access to cryptocurrency after its launch in 2020.

The Libra Association includes a great number of large companies (for more details, see “Analysis of the project team and affiliated persons” section) from different industries, and their number will increase. Currently, it is not known how they will use Libra cryptocurrency in their services. It also became known that some members joined the Association on the condition that they would not promote the project and use cryptocurrency directly in their services, as regulators in many countries expressed a negative opinion regarding Libra.

Information about the integration of Libra with other independent projects is not yet available.

Famous persons in the team

Despite the lack of indication of specific individuals in the project team, the Libra Association includes the most recognizable international companies.

- "Fame of the project" evaluation: 6 points out of 10. The outlook is positive.

Citation, social networks – 3 points out of 3.

Usability / distribution – 0 points out of 2 (the main network has not been launched yet).

Projects based on technology – 1 point out of 3 (despite the lack of details on the integration of Libra cryptocurrency with members of the Association, it is likely that some of them will use Libra).

Famous persons in the team – 2 points out of 2.

The outlook is positive. “Facebook cryptocurrency” will undoubtedly be a widely discussed project and will increase its popularity. It is especially important to monitor how its real audience will grow after launch and the number of services integrating Libra.

The launch of Libra has caused a strong and ambiguous reaction in the community. On the one hand, launching a cryptocurrency of this magnitude can significantly increase the audience of cryptocurrency users and affect the financial services sector, making cryptocurrency payments much more accessible for users around the world. On the other hand, at the first stage Libra will work on the basis of a permissioned blockchain, which will be managed by a narrow circle of companies, which does not comply with decentralization principles and transparency accepted in the crypto community. Libra may turn out to be an unstable to censorship project.

However, the project documentation states the intention to make the Libra network public in the future. But at the moment there is neither a complete concept of the network operation in public mode, nor the time stamps of the planned transition.

Another concern of users is the ambiguous reputation of Facebook social network, which at the current stage is playing a leading role in the development of Libra. Facebook has come across several large-scale user data leaks and it’s unclear if the story will happen again. Also, Facebook is often accused of collecting users’ data and using it for its own purposes, the prospect of disclosure and/or monetization of data on users' financial transactions is perceived negatively.

Calibra wallet will work not only as an independent application, but also as a component of Facebook Messenger and WhatsApp and will require KYC procedures. A large amount of personal data is stored in the social accounts of Facebook users; therefore, it is not clear whether the proper protection of the confidentiality of financial data can be ensured in the case of a direct link between the wallet and the social account. The centralized storage of social and identification data of users in combination with the history of their payments causes many concerns. The crypto community, which seeks decentralization and equality of participants, is skeptical about the emergence of a “monopolist” in the name of Libra.

Another potential risk of the project is the attitude of the regulators. Despite the desire of the project to meet the requirements of regulators, it is unclear how the world will perceive a cryptocurrency with such influence, especially given the fact that this area is still relatively young and the legal field in different jurisdictions is different, and in many has not even been formed. Many governments are wary of the launch of Libra: US congressmen called on Facebook to suspend the work on Libra, Chairman of the State Duma Committee on the Financial Market Anatoly Aksakov has stated that in Russia Libra would not be legalized, etc.

Despite the presence of a large number of fears, many experts positively perceive the launch of Libra, because it can give a strong push to the development of the industry and give access to cryptocurrencies to a huge audience.

- "Trust index" evaluation: 7 points out of 10. Scam probability: below average.

Scam probabiliry is below average. Despite a large number of fears in the community, Libra should be perceived, at least at the current stage, not as a replacement for Bitcoin and a fully independent decentralized project, but as a predominantly corporate solution, which, despite certain shortcomings, can be a step towards mass acceptance of cryptocurrency as a form of payment and the blockchain as a valuable technology. However, one of the main risks at this stage is the negative attitude towards the project in regulatory authorities.

RATING. “Libra” evaluation: 44 points out of 70 – 62.86%. The outlook is neutral.

The outlook is neutral. Libra can not be called cryptocurrency in the full sense of the word because of its corporate nature. However, the project has a number of advantages, including the well-known and authoritative representatives of the Association, as well as the enormous size of the potential audience that can revolutionize the financial sector. It’s definitely worth monitoring the launch of the main network, the acceptance of the project by both users and regulatory structures, as well as the fulfillment of the project promises to switch to a public blockchain. Libra should not be perceived as, for example, a Bitcoin competitor, since at the current stage this project is more like something between classical payment systems and open cryptocurrencies.

Libra is a “corporate” cryptocurrency, backed by a basket of stable currencies launched by large corporations with the main participation of Facebook social network. The project aims to create a global and accessible worldwide payment system. At the same time, instruments for working with Libra cryptocurrency will be integrated into the most popular social applications. Libra can be a compromise between fully decentralized cryptocurrencies and current banking payment systems.

The advantages of the project include:

- The authority and competence of the companies at the head of the project.

- Availability of the test network and instruments for developers.

- High-quality project documentation.

- Availability of collateral in Libra cryptocurrency, which helps to reduce volatility.

- Large coverage of potential user audience.

The disadvantages include:

- The operation on the basis of a permissioned blockchain.

- The lack of details of the planned transition to an public network, including the principles of PoS algorithm and validator fees.

- Centralized approach.

- Negative attitude of regulators in many countries.

- The mandatory KYC in the own wallet can be perceived negatively by some users.

- Absence of the Road Map with a detailed development plan.

References

Official website: https://libra.org

Technical documentation: https://developers.libra.org

Github: https://github.com/libra

Twitter: https://twitter.com/libra_

Facebook: https://www.facebook.com/LibraAssociation/

Instagram: https://www.instagram.com/libra/