BitShares project was presented to the wide audience in 2013 by its founder Daniel Larimer, who is also the creator of STEEM, and initiator of EOS platform creation.

Thanks to the platform, market participants are able to create decentralized autonomous corporations (DAC) based on smart contracts. Thanks to DAC, various companies can automatically sell shares and redistribute profits between shareholders.

The main idea of creating BitShares cryptocurrency is to launch a reliable decentralized asset exchange with high functionality. New platform allows users to pay for subscriptions, monthly payments and more.

BitShares technology was used to create Bitshares DEX — decentralized cryptocurrency exchange, which has Russian localization — RuDex.

The first version of the platform was launched in July 2014. On October 13, 2015, BitShares was updated to version 2.0, now known as Graphene.

A total of 3,600,570,550 tokens were issued. At the moment there are 2'612'400'000 BTS in circulation. The remaining tokens are stored in the Reserve Fund, from which the reward is paid to witnesses and employees.

The issue was stopped on November 5, 2016.

Until 2015, there was a remission in the system. That is, the number of coins was decreasing in quantity over time. This was due to the fact that delegates during the confirmation of transactions were destroying part of the commission from the block. The one who signed the block, was leaving part of the commission to himself (usually 3%) and destroying the remaining 97%. Since 2015, burning no longer happens, but 20% of commission is transferring to the Fund.

BitShares uses a DPOS (Delegated Proof of Stake) algorithm. The author of this algorithm is Daniel Larimer, who created it specifically for BitShares.

Any user with BitShares account can be elected as a delegate, for this certain conditions must be met, the account must have the status of Life Time Member (LTM). BitShares asset holders get one vote for each BTS token they have and can use wallets to indicate which delegates they trust. The delegates who receive the most votes get the rights to add transaction blocks to the network.

The number of delegates depends on the voters: if the majority of users vote for 50 delegates, then 50 delegates will work. The minimum possible number is 11.

Selected witnesses ensure the operation of BitShares blockchain: create blocks and protect the network, set the prices of the physical world for the assets underlying the crypto-derivative BitAsset, such as the USD or gold. Delegates provide pricing information to the blockchain, creating a stream of quotes (delegates more often update prices in the periods of high volatility). The software sets the median to reduce the possibility of a “dirty game” from the side of delegate in an attempt to manipulate the price. All prices introduced by delegates are open, and any attempt to manipulate the price will result in a quick disqualification of the delegate. This is one of the areas in which BitShares relies on people's trust, not on math.

Detailed description of DPOS algorithm:

http://docs.bitshares.org/bitshares/dpos.html.

Additional blockchain protection is the use of Transaction as Proof of Stake (TaPoS) algorithm. Each transaction in the network may additionally include the hash of the last block. If this is done, transaction subscriber can be confident that their transaction cannot be applied to any blockchain that does not include this block. A side effect of this process is that over time, all interested parties directly confirm the entire transaction history.

BitShares 2.0 works on Graphene blockchain framework. BitShares's strength is considered to be high speed and low cost of transactions; for this, developers, among other things, had to abandon PoW and create a new consensus algorithm — DPoS. The platform also pays great attention to confidentiality, using Blockstream stealth transactions. Cheapness of transactions is possible due to the fact that Graphene platform supports payments with zero commission.

The size of commission is established by the Committee. Detailed information on current commissions and the price list can be found on BitShares Committee website or RuDEX Market.

Other benefits of Graphene-based platforms:

- Possibility of getting reward not only by miners, but also by other active members of the system.

- Possibility of working with with several tokens in one system at once.

- Possibility of binding the value of the token (or, for example, the lower threshold of its price) to another currency, precious metals, etc. This binding is valid on the internal level of the system. That is, in the presence of several tokens and one tied, for instance, to USD, the internal exchange will always be at the rate of USD.

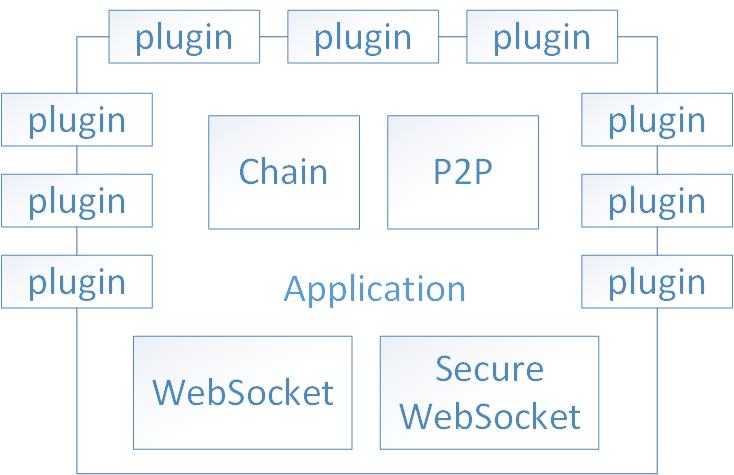

Graphene architecture is a monolithic application into which Graphene plugins are compiled:

Inside there is a chain initialization, initialization of synchronization object, which is marked as P2P, and initialization of two types of WebSocket.

Despite its innovativeness, the platform has limitations. Learn more about this in the lecture by Alexander Borgardt, developer of Golos Core.

BitShares is controlled by Decentralized Autonomous Corporation (DAC), which allows BitShares owners to contribute and ultimately decide on the future direction of BTS.

BitShares is designed to exist as a self-financing and self-sufficient system. This is ensured by transferring to interested parties the powers to address where the blockchain reserves are spent. BitShares has a general reserve, at the moment (March 14, 2018) it is just under 1 billion BTS, which automatically increases as commission fees are collected for operations. Every day, the blockchain is authorized to spend up to 432’000 BTS, which is enough to hire a small team to support the network for many years, even without a cost increase.

US Federal Securities Act uses the so-called Howie test, which allows to determine whether an entity is a type of security and is subject to regulation by SEC.

In the context of blockchain tokens, Howie test can be expressed in the form of three independent elements (the third element covers both the third and fourth paragraph of traditional Howie test). For a token to be considered as a security, all three elements must be present. In the case of BitShares, these elements are missing.

In addition, BitShares complies with 6 principles according to which blockchain tokens cannot be interpreted as securities in accordance with US laws:

- Principle 1: Publish detailed technical documentation: yes

- Principle 2: For pre-sales, develop a Road Map: yes

- Principle 3: Use an open, public blockchain and publish all the code: yes

- Principle 4: Use clear, logical and fair pricing when selling tokens: yes

- Principle 5: Determine the percentage of tokens allocated to the development team: 0%, fully controlled by shareholders

- Principle 6: Avoid marketing a token as an investment: BTS was selling as a share in decentralized autonomous company; the initial distribution of 50% consisted of mined tokens and 50% — of donations.

Among close to regulators persons, there was an opinion that part of BitShares documentation defines market-related assets as CFDs, which makes them illegal in some jurisdictions, including the United States.

After further investigation and legal advice, it turned out that this confusion was caused by a slight lack of understanding of technical details, as a result of which these assets were presented as CFDs by mistake.

Contract for difference is a type of derivative financial instrument where two parties exchange the difference between the initial value and the value at the end of base asset.

However, the basic smart contract implemented on BitShares is a secured loan, where the borrower (user) receives funds (for example, bitUSD) from a smart contract (blockchain) by providing sufficient deposit.

It is clear that in some part of documentation this distinction may have been misinterpreted or distorted. Plus, BitAssets are loans and are therefore fully legal in most jurisdictions.

BitShares is the first exchange platform approved by TXSRB (Token Exchange Self-Regulation Organization — a crypto-community that checks blockchain projects).

Any company that accepts customer deposits and makes transactions between customers is strictly regulated in most countries. Regulatory requirements for them mean availability of licenses, guarantees, insurance, compliance with KYC (Know Your Customers), consent to countering money laundering, etc. BitShares blockchain provides its gateways with all the necessary tools to comply with these regulatory requirements.

- "Architecture and Logic" evaluation: 10 points out of 10. The outlook is positive.

Mechanisms and principles of emission — 3 points out of 3.

Blockchain (architecture and consensus building mechanism) — 4 points out of 4.

Licensing and legal aspects — 3 points out of 3.

The outlook is positive. An innovative platform with stable and secure architecture that has passed the test of time.

BitShares has high bandwidth thanks to the use of DPoS algorithm.

Underlying BitShares Graphene blockchain was capable of supporting around 2’500 TPS. With Graphene 2.0, the speed is already over 3’000 TPS and can be increased in many times. During tests, Graphene was able to make 10’682 transactions per second. In this case, creators talk about the possibility of increasing to 100’000 transactions per second.

The use of Graphene-networks technology allows to achieve significant improvements in terms of scaling by eliminating a number of features of traditional blockchains. For example, since the hashing process consumes quite a lot of resources, BitShares does not hash users’ IDs, but simply assigns an identifier to them. And the logic of creating smart contracts is simplified and primarily aimed at maintaining high performance.

SmartCoin currency is a cryptocurrency, the value of which is connected with the value of other assets, such as USD or gold. 100% or more of the cost of SmartCoin coins is always supported by the base BitShares currency, BTS, into which they can be converted at any time at the exchange rate set in accordance with the reliable quotation flow, generated by delegates. In all but the most extreme market conditions, it is guaranteed that SmartCoin coins will have at least their minimum value (and possibly more, in some circumstances). Like any other cryptocurrency, SmartCoin coins are multifunctional, divisible and free from any restrictions.

BitShares provides a high-performance decentralized exchange, with all the features that can be expected from a trading platform.

Each account can be controlled by any combination of other accounts and private keys. It creates a hierarchical structure that reflects how permissions are organized in real life, and makes multi-user control over funds easier than ever. Multi-user control is one of the biggest security factors and, if used properly, it can almost completely eliminate the risk of theft due to hackers.

BitShares is the first platform based on smart contracts with built-in support for periodic payments and subscription payments. This feature allows users to provide third parties with the ability to withdraw funds from their accounts to a limited extent. This is a convenient way to make regular payments.

BitShares is equipped with an advanced referral program embedded directly in its software. The value of financial networks is formed mainly due to their network effect: an increase in the number of people on the same network increases the value of this network for everyone. BitShares uses this effect, rewarding those who attract new users, and it does it in a completely transparent and automated way.

BitShares offers a feature known as “user-issued assets” that makes it possible to promote profitable business models for certain types of services. The platform allows to register individual tokens that users can store and sell to a limited extent. The creators of such assets are publicly call, describe and distribute their tokens, and can set individual requirements, such as approving a white list of accounts that are allowed to keep tokens, or the implementation of trade and transfer fees.

Personal accounts allow users to easily remember and transfer information about their account.

BitShares 2.0 has been operating for more than 3 years and has never been hacked.

Over the years of operation, BitShares blockchain had only two problems with consensus, when the mining of blocks was stopped for only a few hours. Herein users’ funds were not endangered. It was revealed that blockchain nodes lose contact with P2P network, and as a result, synchronization with the rest of the network is interrupted. The main reason for this has already been identified, and a (non-consensus) patch has been developed. The main developers no longer received reports of this problem from any parties affected by it, and they themselves never encountered this rather rare event.

BitShares Core client can be downloaded from GitHub under Windows, Mac and Linux:

- Latest client version:

https://github.com/bitshares/bitshares-core/releases/latest

- Latest GUI version:

https://github.com/bitshares/bitshares-ui/releases/latest

All necessary documentation for installation, integration, development, API, etc. is available at the link:

http://docs.bitshares.org/

At the technical support forum you can get answers to your questions and technical support from the developers.

Wallets:

- for Windows, Mac, Linux:

https://bitshares.org/download/; - web wallets:

https://wallet.bitshares.org/ and on OpenLedger service; - mobile wallets:

- for Android — Smartcoins Wallet;

- for Android — BitUniverse;

- for iOS — DoorOne.

By managing a legal cryptocurrency exchange, you can expand your business by becoming a BitShares gateway. A gateway is a trusted party that manages the introduction and withdrawal of funds to and from BitShares network, respectively.

Any payment systems have the ability to integrate software through an application programming interface (API).

- "Functional and software platform" evaluation: 10 points out of 10. The outlook is positive.

Performance and scalability — 2 points out of 2.

Built-in mechanisms and functions — 3 points out of 3.

Product — 4 points out of 4.

Integration options — 1 point out of 1.

The outlook is positive. High operations speed, low commissions, wide functionality, high level of security. Bitshares blockchain has been successfully operating for more than three years.

October 3, 2017 Bittrex announced that the following trading pairs will be removed on October 13: BTC-BTS and ETH-BTS.

Bitstamp, Bithumb, GDAX, HitBTC, Kraken, Gemini and other exchanges — all refused to list BTS, despite it is one of the oldest and most used coins with the most transactions on the planet. Crypto community suggests that they simply do not want to support a competitor.

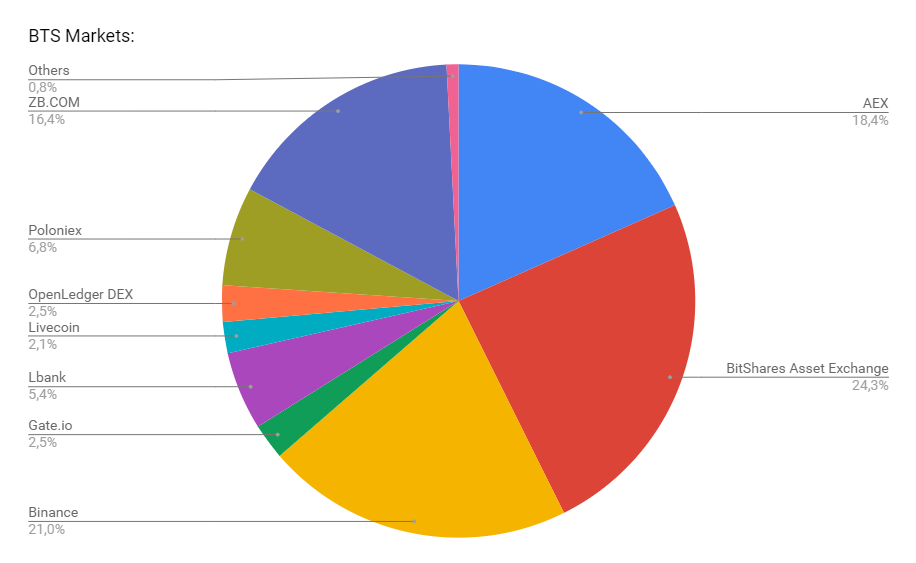

At the moment, BTS token is presented on the following exchanges (data from coinmarketcap.com on March 14, 2018):

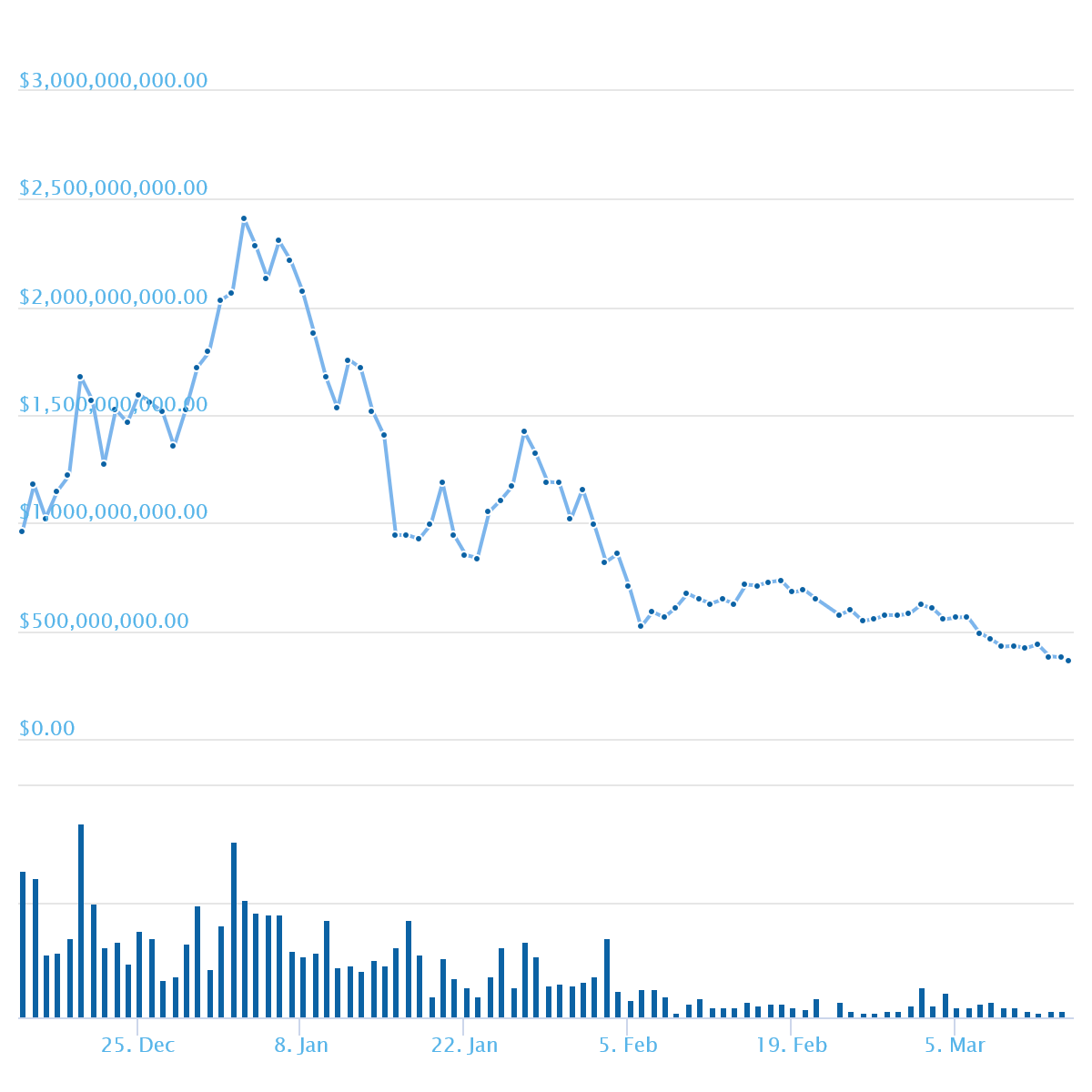

The first sharp increase was on June 19, 2017, when capitalization reached to $1 billion. Then the inevitable fall followed with a short period of stabilization. In October 2017, the capitalization fell to almost $130 million. Then, the growth followed after the entire crypto market. And on January 2, 2018, the maximum capitalization value at the moment was reached — $2.3 billion.

Now the capitalization is more than $391 million (March 14, 2018), and BitShares ranks 38th place in cryptocurrency rating for this parameter criteria.

Capitalization dynamics of BTS for the past 3 months:

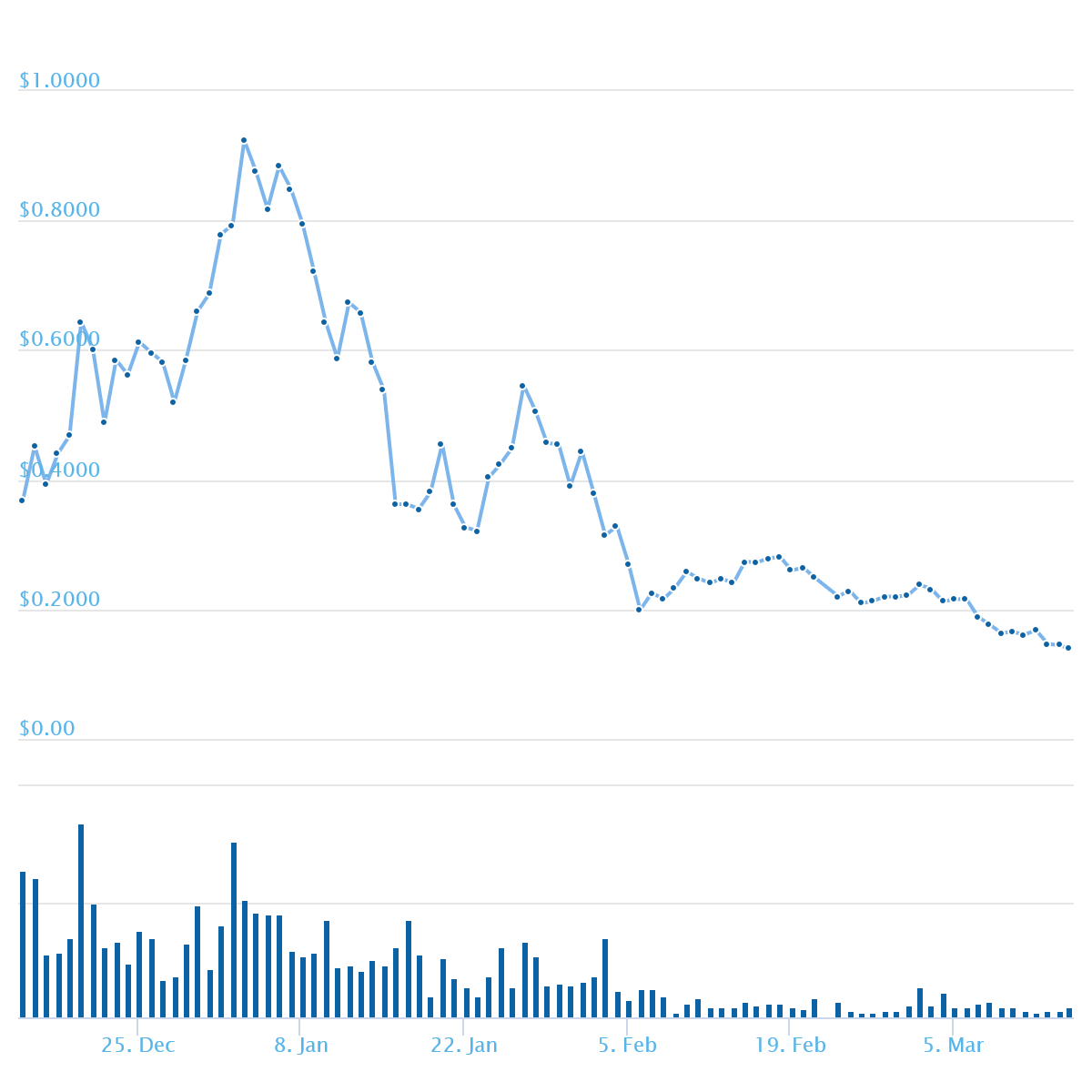

Since its launch in October 2014, BitShares were trading in the range of <1 cent to <4 cents and didn’t bring significant income to investors. However, when the rapid growth of digital assets began in the spring of 2017, the price of BitShares along with altcoin market rose significantly: right up to a record maximum of $0.45 on June 10, 2017. From early September to mid-October, there was a steady decline, when the price of the token fell to 5 cents. After that, the growth began along with the market until January 3, 2017, when the current historical maximum price was reached — $0.92.

Now there is a recession period again. At the moment, the price of the token is $0.14 (according to coinmarketcap.com as of March 14, 2018).

Token price dynamics for the last 3 months:

- "Statistics" evaluation: 7 points out of 10. The outlook is neutral.

Distribution — 3 points out of 4 (several major exchanges refused to list the token).

Token price and capitalization dynamics — 4 points out of 6 (there is a dependence on market movement, there were serious fluctuations in the token price, however, in the last month there was a rather long stabilization period).

The outlook is neutral. Not all exchanges agree to list the token, and reducing number of exchange platforms is not a very good trend. Despite the token price reduction and the volume of trades, there is a decrease in volatility. In case if stability of rate behavior mantains and the trend changes to rising, the outlook may be revised.

Bitshares has published 3 White Papers:

- general description,

- financial platform of smart contracts;

- stress tests results.

The first two documents contain very detailed technical and economic information about the platform. All aspects and functionality are clearly and fully described.

The third document contains the result of stress test on a public test network. Testnet was launched with the same code base that is used for BitShares network. Multiphase stress testing was made, which was changing the maximum transaction size, maximum block size, and block confirmation time. Validators were constantly updated by a rate vote. This document is unique for such projects, it shows clearly the possibilities of the platform, its compliance with the declared characteristics, as well as the team’s approach to development and users.

At the moment (March 18, 2018) there is no up-to-date White Paper in the public access. The team announced that the documentation is currently being updated to improve its quality. Upon completion, WP will be available at the link:

http://docs.bitshares.org/bitshares/papers/index.html.

Official Road Map:

https://bitshares.org/roadmap.html

Very detailed table with the status of the tasks, their cost, links to the result. However, the planning horizon is small — 1 year, besides, the last update is from January 01, 2016.

Unofficial Road Map can be found in BitShares topic on Bitcointalk:

https://bitcointalk.org/index.php?topic=1949828.0.

It contains aggregated information from different sources, collected by various participants, starting from members of BTS DAO and ending with volunteers. This Road Map contains the latest information, but since it is not official, it is recommended to recheck it.

The team publishes weekly reports on BitShares network status:

https://steemit.john-at-me.net/trending/bitshares.

- "Analysis of Road Map and White Paper" evaluation: 6 points out of 10. The outlook is neutral.

White Paper — 4 points out of 5 (minus point for a long absence of documentation during the period of its updating).

Road Map — 2 points out of 5 (outdated information with a small planning horizon).

The outlook is neutral. White Paper's high quality is leveled by the actual absence of Road Map. The new version of White Paper is absent for a long time, it is necessary to monitor its appearance. After the appearance of new version of WP and the assessment of its quality, the outlook may be changed.

Team

One of the main developers of the platform is Daniel Larimer, well-known in the world of blockchain technologies. He is the developer of not only BitShares project, but also STEEM, and he has also acted as the initiator of EOS platform creation.

The launch of BitShares network in 2014 was carried out by Invictus Innovations company. After some time, Invictus Innovations began to deal exclusively with payment processing and financial reporting in the US, and funds for developing BitShares dried up. It was quite predictable, so Daniel and Stan Larimer decided to create a new company that would better meet the needs of owners and developers operating directly in the US, and would develop new business directions. Cryptonomex, which was created in the spring of 2015, became such a company. Also, an additional company was created that focused its efforts on the work in Asian market. In August 2015, Cryptonomex managed to release a new product — Graphene technology. It allowed to upgrade BitShares to BitShares 2.0. And although Graphene was an innovative and rather sensational product — it still did not lead to a steady increase in the value of company's shares. No new funding was received. There was less and less money for further development and maintenance of the product, so the team focused its efforts on finding new investors. After some time, Cryptonomex company has split into several new companies that had their own managers, who were independently engaged in searching for investors and moving along a certain marketing strategy.

The author of the final touches of BitShares was one of the creators of Ethereum — Charles Hoskinson.

The core team of the project creators also included:

- Ned Scott — Independent Director of Steemit, Inc. At first he entered BitShares ecosystem by assisting in the development of this business and was later appointed to Steemit management.

- Annemieke Dirks — Cryptonomex CEO, International (CNI). She has extensive experience in managing technology companies and a good grip on solving any difficult issue. Business development is one of her many skills, and she is currently busy preparing and concluding contracts throughout FinTech industry.

- Ronald Kramer — was responsible for formation of CNI and recruitment for Annemieke. He was Chief Financial Director and worked on structuring of a number of subsidiaries in order to bring new liquidity, products and services to BitShares ecosystem.

- Fabian Schuh — perhaps the most famous technical expert in the ecosystem after Dan Larimer. He participated absolutely in all developments as Chief Technology Director for both CNI and CNF companies, and also made a great contribution to Steemit. As part of Cryptonomex Foundation, he acquired knowledge of advanced technologies of blockchain, which this company gained after several years of research.

- Michael Taggart — Director of Marketing in CNF and CNX companies and the leading developer of business models for the entire industry in terms of the total cost of opportunities available in this industry. He is a master in Internet marketing technology and a leading innovator in this field.

- Stan Larimer — president of Cryptonomex.

Currently, project activities are supported by:

- BitShares Blockchain Foundation, offers open mailing lists, publishes press releases, supports contacts with exchanges and manages several employees to contact the community. Representatives of this fund are Annemieke Dirks and Fabian Schuh.

- BitShares Foundation (BF) offers so-called multi-signature contracts using escrow, for example, for ICO, for storing funds before release, or for keeping funds in case of conflict situation for not to worry about existing assets.

- And also by all active users of the network, thanks to the availability of a Decentralized Autonomous Corporation (DAC).

Investors

Chinese magnate Li Xiaolai became the first investor in June 2013.

Partners

BitShares will provide a complex platform for providing real-time financial products and services for AriseBank customers — the world's first decentralized cryptocurrency bank. Member of the bank directors board D. Rice announced that the partnership with decentralized platform will have a positive impact on the development of universality and security of banking sector and will allow the introduction of innovative projects.

Banx Capital announced on June 23, 2015 that it will cooperate with BitShares and transfer its services to this platform.

Bitspark moves from Bitcoin to BitShares DEX and takes its volumes of millions of USD in money transfers, because BitShares is faster, offers smart contracts (bitCNY, bitUSD, bitAnyOtherCurrencyInTheWorld) and is scalable to 100,000+ transactions per second.

5."Analysis of the project team and affiliated persons" evaluation: 10 points out of 10. The outlook is positive.

The number of the team — 2 points out of 2.

Team structure — 3 points out of 3.

Team competencies — 3 points out of 3.

Affiliated persons – 2 points out of 2.

The outlook is positive. Numerous and experienced team, with the legends of crypto world at the head, which is constantly updated with new members, thanks to a self-financing system.

Competition from international exchanges that are working on a similar blockchain-based solution may be a threat to BitShares success.

There are other competitors in the blockchain world, for example, Waves platform, which has rapidly gained momentum over the past six months or a year and that positions itself as BitShares direct competitor. At the moment, Waves significantly bypasses BitShares, being in 29th place in the general list of cryptocurrencies, versus BitShares’ 38th place (according to coinmarketcap.com as of March 14, 2018). However, Waves, as well as MakerDAO, is far from the level of BitShares’ development/documentation and does not have all its functions.

EOS and OpenANX are under development.

Other alternatives, such as Tether, are centralized and have counterparty risks.

Other payment systems, such as Ripple or Stellar, in fact, do not have the ability to transfer value and are no different from using MySQL database; or these are cryptocurrencies that may be better for payments than Bitcoin, but do not have liquidity and do not meet the criteria for creating decentralized, fiat-linked cryptocurrencies, i.e., excellent for banks but not for money transfer providers.

- "Competitors" evaluation: 6 points out of 10. The outlook is positive.

Direct competitors — 3 points out of 4 (there are direct competitors, but they are either lagging behind in development, or do not have such a broad functionality).

Industry competitors — 2 points out of 4 (high industry competition).

Project monitoring of competition — 1 point out of 2 (comparisons with Waves are mentioned in blogs or in interviews of team members; there is no competition monitoring in project documentation)

The outlook is positive. Despite the competition, Bitshares confidently occupies its niche of a decentralized crypto exchange.

Citation, social networks

For a long time the project was not mentioned very often in the news, which indicates a weak marketing promotion of the platform. The developers focused their attention on the technological advantage of the project, and they did little to advertise and promote the project in the blockchain area.

However, now the situation is changing. On billionherocampaign.com, you can see a huge marketing campaign that draws attention to BitShares brand. Information about the technology gets to the US and Caribbean governments, celebrities, public campaigns and traditional startups.

Now BitShares is a fairly well-known project and is often mentioned in various news about the crypto market along with popular projects from TOP-10 by capitalization.

Project activity in social networks:

- Reddit — 7127 subscribers,

- Twitter — 89042 readers,

- Telegram (main chat) — 11678 members,

- Facebook — 11657 followers.

Usability/Applicability

BitShares has the longest blockchain in the world, with a record number of transactions per day. The current record (July 10, 2018) is 5.158 million transactions per day. The closest competitor on this indicator is Steem, in which the number of transactions per day barely exceeds 2.5 million, according to Blocktivity data.

The work of the network can be monitored on one of the following explorers: http://cryptofresh.com/ (temporarily not working as of July 10, 2018), http://bts.ai, http://open-explorer.io.

In total, 128 attestor-nodes are currently registered in the network. Over 180 assets are created. BTS token holders — 165,592.

Projects on BitShares

OpenLedger decentralized exchange is the first blockchain-based conglomerate implemented on the basis of BitShares. OpenLedger includes several projects, such as GetGame, OCASH, eDEV.one and Apptrade, designed to diversify the work of the network and to make it more convenient.

GetGame project is developing new features in the gaming industry, focusing on virtual and augmented reality products and blockchains.

eDEV.one is a blockchain-based platform for freelancers.

RuDEX is Russian-language localization of BitShares DEX decentralized trading platform. RuDEX is, in fact, an entry point to a decentralized market that provides a set of advanced trading tools, but remains accessible to less experienced users.

BitShares is used to create STOKENS exchange for issuing and trading tokens that meet SEC conditions. This should contribute to the fact that projects will give preference to BitShares when conducting an ICO, as companies will be forced to follow the rules set by SEC and other government regulators.

Many ICOs are already launching on Bitshares: Smoke, Kexcoin, Bitspark, Satoshi.fund, Bondonblockchain, Crypviser, YOYOW, Zephyr.

MUXER decentralized community will operate on the basis of BitShares platform, and use BTS currency. This community will help its members in difficult legal or financial situations. It is assumed that this social network will represent a group of societies united by one type of risk or another. Larimer calls as an example marijuana society that helps people accused of possessing this drug. Another society could help those who is persecuted for copyright infringement. It is possible to become a member of any society, donate money and, if necessary, get help. The general idea is to mitigate "unlikely, but costly risks." Many bypass copyright laws, but few are punished for it; donating a small amount of money, you provide yourself financial support in the event that you yourself get into such an unpleasant situation.

POS system (Point of Sale) for retail stores — BlockPay S, supporting multiple cryptocurrencies. The system implements anonymous Stealth Transactions using BitShares blockchain. BlockPay S can be downloaded for free at any point of sale connected to BitShares system. Retailers or business owners working with existing POS systems, vending machines, kiosks, Odoo, SAP, Shopkeep, NCR and other POS platforms can integrate BlockPay via API. In the summer of 2017, the project was divided into two independent ones.

Crypviser — the first encrypted network for social and business communication was transferred in the summer of 2017 from Ethereum to BitShares.

In August 2017, Bitspark money transfer system refused Bitcoin in favor of BitShares.

Famous persons in the team

Platform creator Dan Larimer is one of the most famous persons in crypto world. Just as well as joined to him Charles Hoskinson — one of the creators of Ethereum. Daniel and Stan Larimer created a company that developed Graphene technology, which not only formed the basis of BitShares 2.0, but is also used by other blockchain projects.

- “Fame of the project" evaluation: 10 points out of 10. The outlook is positive.

Citation, social networks — 3 points out of 3.

Usability/applicability — 2 points out of 2.

Projects based on technology — 3 points out of 3.

Famous persons in the team — 2 points out of 2.

The outlook is positive. This project is well-known and actively used all over the world; the founder is world famous in the field of blockchain technologies and has made a significant contribution to its development.

RATING. “BitShares” evaluation: 59 points out of 70 — —84.28%. The outlook is positive.

The outlook is positive. Innovative platform created by experts in their field. Actively maintained and developed. It has a wide range of competitive advantages.

The advantages of BitShares platform, which confirm its applicability:

- High operations speed, low commissions, wide functionality features, high level of security.

- Numerous and experienced team of developers, which systematically performs its tasks and works on independent project development.

- The relevance of the platform is confirmed by work projects that operate on it.

- BitShares blockchain has been in a fully functional state for more than three years and has already passed the viability testing phase.

- Delegates system allows the certain "trusted" persons, who can not take away all the possibilities for the sole management of the platform, to support the project.

- BitShares blockchain allows to quickly make transactions between users, and also supports high network loads.

- At the moment, BitShares provides more benefits to money transfer companies intending to use cryptocurrency as a means of faster and cheaper sending money to a large number of places (Bitspark).

Disadvantages:

- Weak marketing promotion of the platform until recently. In the near future, the recognition and fame of the project should increase thanks to a large marketing campaign on billionherocampaign.com.

- Since tokens with different characteristics can be released by any users, this creates favorable conditions for the work of fraudsters.

- In the fall of 2014 and spring of 2017, there were serious fluctuations in the price of the token, but after that the values returned to normal levels.

- Another area of difficulty for new members of the community is the long mastery of the user interface, outdated documents on bithares.org and the lack of gateways. These are not protocol problems, but rather opportunities for someone to improve the platform with the help of a working proposal or for a business to create a new resource — a hub for information and a new trade interface. Built-in voting and a decentralized exchange as part of a non-demanding network is something that few, if any, cryptocurrencies have, and therefore there is plenty of room for improvement.

In general, BitShares is a promising system that should definitely cause interest among those involved in trading and investing, because it is an excellent example of a safe and decentralized exchange.

References

BitShares official website — http://bitshares.org/

BitShares explorer — http://cryptofresh.com/

BitShares forum — https://bitsharestalk.org/

BitShares Russian speaking forum — https://bitsharestalk.org/index.php/board,19.0.html

GitHub: https://github.com/bitshares

Reddit: https://www.reddit.com/r/BitShares

Twitter: https://twitter.com/bitshares

Telegram: https://t.me/BitSharesDEX

- “Fame” section was added as an additional parameter for project evaluation. The weight of the section in the rating system is 10 points.

- “Projects on BitShares” subsection was moved from “Functionality and software platform” section to “Fame” section and supplemented.

- In connection with changes indicated in par. 2, evaluation of “Functionality and software platform” section has changed from 12 out of 12 to 10 out of 10.

- The content of “Project Fame” subsection was moved from “Statistics” section to “Fame” section.

- In connection with changes indicated in par. 5, there was made a redistribution of points of “Statistics” section evaluation, the overall evaluation did not change.

In connection with the above changes, the overall rating of the project has changed from 51 points out of 62 — 82.26% to 59 points out of 70 — 84.28%.